I was asked to make a brief contribution to discussion of the President's Executive Order on Ensuring Responsible Development of Digital Assets, concentrating on the technological risks they involve over and above those of conventional financial assets. Below the fold is my contribution with links to the sources.

I'm David Rosenthal, and this is a place to discuss the work I'm doing in Digital Preservation.

Wednesday, July 27, 2022

Tuesday, July 26, 2022

The Internet Archive's "Long Tail" Program

In 2018 I helped the Internet Archive get a two-year Mellon Foundation grant aimed at preserving the "long tail" of academic literature from small publishers, which is often at great risk of loss. In 2020 I wrote The Scholarly Record At The Internet Archive explaining the basic idea:

The project takes two opposite but synergistic approaches:Below the fold I report on subsequent developments in this project.

- Top-Down: Using the bibliographic metadata from sources like CrossRef to ask whether that article is in the Wayback Machine and, if it isn't trying to get it from the live Web. Then, if a copy exists, adding the metadata to an index.

- Bottom-up: Asking whether each of the PDFs in the Wayback Machine is an academic article, and if so extracting the bibliographic metadata and adding it to an index.

Thursday, July 21, 2022

Mining News

|

| Source |

In simple terms, this excess depreciation means that the company's real cost for creating income is much higher than they report, and thus their real profit as a continuing business is much less than they report, because they are not putting aside the money they will need to replace obsolete hardware.This was written a couple of weeks after the Terra/Luna crash started on May 7th, triggering the current "crypto winter", too early to see the effect on miners. Now, as the contagion spreads and successive cryptocurrency companies file for bankruptcy, we are starting to see the knock-on effects. Below the fold, a collection of news about mining.

Tuesday, July 19, 2022

Calls For Cryptocurrency Regulation

On 8th July 2022 Lael Brainard, Vice-Chair of the Federal Reserve governors gave a speech entitled Crypto-Assets and Decentralized Finance through a Financial Stability Lens in which she writes:

Distinguishing Responsible Innovation from Regulatory EvasionThe G20's Financial Stability Board followed with FSB Statement on International Regulation and Supervision of Crypto-asset Activities making a similar pitch for regulation. As did the European Central Bank with Decentralised finance – a new unregulated non-bank system?. Paul Krugman asks the right question in Crypto Is Crashing. Where Were the Regulators?:

New technology often holds the promise of increasing competition in the financial system, reducing transaction costs and settlement times, and channeling investment to productive new uses. But early on, new products and platforms are often fraught with risks, including fraud and manipulation, and it is important and sometimes difficult to distinguish between hype and value. If past innovation cycles are any guide, in order for distributed ledgers, smart contracts, programmability, and digital assets to fulfill their potential to bring competition, efficiency, and speed, it will be essential to address the basic risks that beset all forms of finance. These risks include runs, fire sales, deleveraging, interconnectedness, and contagion, along with fraud, manipulation, and evasion. In addition, it is important to be on the lookout for the possibility of new forms of risks, since many of the technological innovations underpinning the crypto ecosystem are relatively novel.

Traditional banking is regulated for a reason; crypto, in bypassing these regulations, [Lael Brainard] said, has created an environment subject to bank runs, not to mention “theft, hacks and ransom attacks” — plus “money laundering and financing of terrorism.”Below the fold I argue that these calls are both very late, and are couched in self-defeating language.

Other than that, it’s all good.

The thing is, most of Brainard’s litany has been obvious for some time to independent observers. So why are we only now hearing serious calls for regulation?

Tuesday, July 12, 2022

Pump-and-Dump Schemes

On June 29th the SEC rejected the application from Grayscale Bitcoin Trust to launch a Bitcoin ETF. Among the justifications the SEC provided for their decision were (page 22, my re-formatting):

The Commission has identified in previous orders possible sources of fraud and manipulation in the spot bitcoin market, including:Bitcoin and the wider cryptocurrency markets have a long history of "persons with a dominant position in bitcoin manipulating bitcoin pricing" and "manipulative activity involving purported “stablecoins,” including Tether (USDT)". Among the techniques involved are "pump-and-dump" schemes. Below the fold I review the literature on these schemes, and follow up with a critique.

- “wash” trading;

- persons with a dominant position in bitcoin manipulating bitcoin pricing;

- hacking of the bitcoin network and trading platforms;

- malicious control of the bitcoin network;

- trading based on material, non-public information (for example, plans of market participants to significantly increase or decrease their holdings in bitcoin, new sources of demand for bitcoin, or the decision of a bitcoin-based investment vehicle on how to respond to a “fork” in the bitcoin blockchain, which would create two different, non-interchangeable types of bitcoin) or based on the dissemination of false and misleading information;

- manipulative activity involving purported “stablecoins,” including Tether (USDT);

- fraud and manipulation at bitcoin trading platforms

Friday, July 8, 2022

Economic Model Revived

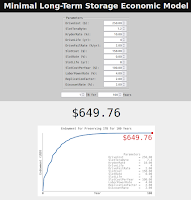

Five years ago, at the urging of the Internet Archive, I implemented a simple interactive version of the Economic Model of Long-Term Storage in Python. It estimated the endowment needed to store a Terabyte for 100 years based on a set of parameters that people could vary. It ran on a Raspberry Pi at the end of our Sonic DSL home Internet connection. The endowment is the capital which, together with the interest it earns, is enough to cover the costs incurred stoing the data for the century.

Five years ago, at the urging of the Internet Archive, I implemented a simple interactive version of the Economic Model of Long-Term Storage in Python. It estimated the endowment needed to store a Terabyte for 100 years based on a set of parameters that people could vary. It ran on a Raspberry Pi at the end of our Sonic DSL home Internet connection. The endowment is the capital which, together with the interest it earns, is enough to cover the costs incurred stoing the data for the century.Alas, the Pi became a casualty when, early in the pandemic, we upgraded to the wonderful Sonic gigabit fiber (Best ISP Evah!), needed to support multiple grandkids each in a different virtual school.

Fortunately, Sawood Alam at the Internet Archive has forked the code, re-implemented it in Javascript, improved the user interface, and deployed it at Github. This new version is once again available here. I'm very grateful to Sawood and the team at the Internet Archive, both for pushing me to do the initial implementation, and now for bringing it back from the dead.

Below the fold I have a couple of caveats.

Tuesday, July 5, 2022

It's Still Not About The Technology

I, like many others, signed the Letter in Support of Responsible Fintech Policy, saying:

Bruce Schneier responded with On the Dangers of Cryptocurrencies and the Uselessness of Blockchain. Below the fold, I argue that both of them have missed the most important point.

We strongly disagree with the narrative—peddled by those with a financial stake in the crypto-asset industry—that these technologies represent a positive financial innovation and are in any way suited to solving the financial problems facing ordinary Americans.In response, famed cryptographer Matthew Green, who I'm told HODLs ZCash and is involved in a blockchain startup, posted In defense of crypto(currency), basically arguing against regulating cryptocurrencies because, although their current state is rife with crime and is cooking the planet, better technology is possible.

Bruce Schneier responded with On the Dangers of Cryptocurrencies and the Uselessness of Blockchain. Below the fold, I argue that both of them have missed the most important point.

Subscribe to:

Comments (Atom)