Now, Yves Smith's Fed Economists Finger Monopoly Concentration as Underlying Driver of Neoliberal Economic Restructuring; Barry Lynn in Harpers and Fortnite Lawsuit Put Hot Light on Tech Monopoly Power covers three developments in the emerging anti-monopoly consensus:

- Apple and Google ganging up on Epic Games.

- Lina M. Khan's ex-boss Barry Lynn's The Big Tech Extortion Racket: How Google, Amazon, and Facebook control our lives.

- Market Power, Inequality, and Financial Instability by Fed economists Isabel Cairó and Jae Sim

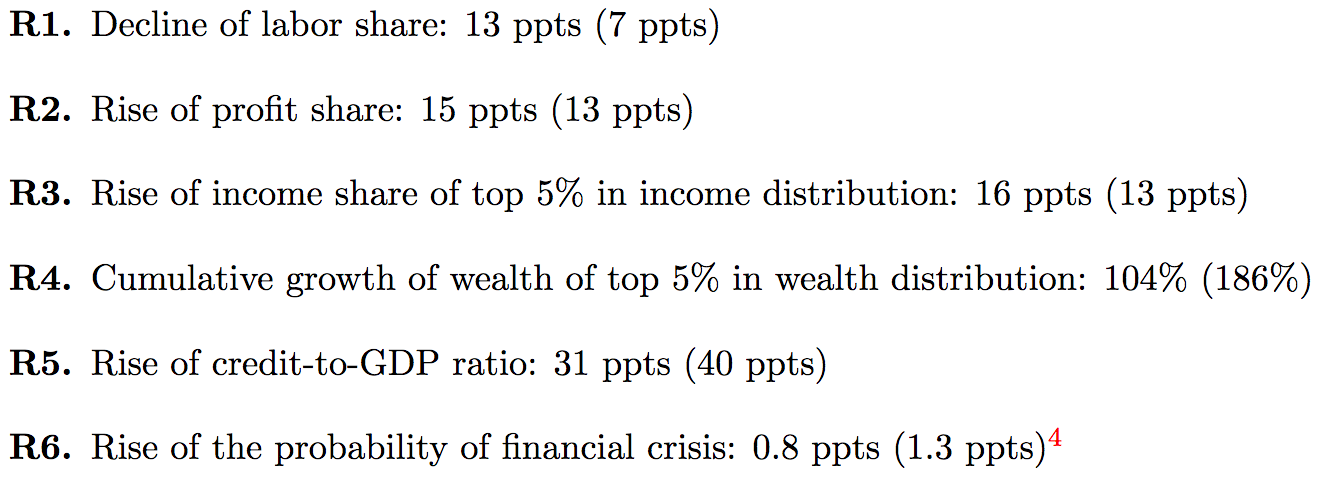

they developed a model to simulate the impact of companies’ rising market power, in conjunction with the assumption that the owners of capital liked to hold financial assets (here, bonds) as a sign of social status. They wanted to see it it would explain six developments over the last forty years. ... And it did!Follow me below the fold for the details.

Yves Smith lists the six developments:

- Real wage growth stagnating and lagging productivity growth

- Pre-tax corporate profits rising rapidly relative to GDP

- Increasing income inequality

- Increasing wealth inequality

- Higher household leverage

- Increased financial instability

For a model to have pretty decent fit for so many variables is not trivial. The first are what the model coughed up, the second, in parenthesis, are the real world data:Here is Cairó & Sim's abstract:

...

The authors did quite a few sensitivity test and also modeled some alternative explanations, as well as showing panels that compared model outputs over time to real economy outcomes. They also recommend wealth distribution as a way to dampen financial crises, or even just taxing dividends at a healthy level.

Over the last four decades, the U.S. economy has experienced a few secular trends, each of which may be considered undesirable in some aspects: declining labor share; rising profit share; rising income and wealth inequalities; and rising household sector leverage, and associated financial instability. We develop a real business cycle model and show that the rise of market power of the firms in both product and labor markets over the last four decades can generate all of these secular trends. We derive macroprudential policy implications for financial stability.Their model contains two kinds of agents, owners of capital who lend, and workers who borrow:

The first type of agents, named agents K, whose population share is calibrated at 5 percent, own monopolistically competitive firms and accumulate real (capital) and financial assets (bonds). The second type of agents, named agents W, whose population share is calibrated at 95 percent, work for labor earnings and do not participate in capital market, but issue private bonds for consumption smoothing. The two types of agents interact in two markets. In the labor market, they bargain over the wage. In the credit market, agents K play the role of creditors and agents W the role of borrowers.What is going on here is that the agents K want to lend as much money as possible, so as to receive interest. In order for them to do this, it is necessary for the agents W to borrow as much money as possible:

We assign so-called spirit-of-capitalism preferences to agent K such that they earn direct utility from holding financial wealth, which is assumed to represent the social status

We show that such preferences are key in creating a direct link between income inequality and credit accumulation, as they control the marginal propensity to save (MPS) out of permanent income shocks.Agents K in the model want to lend money, rather than directly own productive capital resources. The authors tried changing this, so that agents K owned real capital assets, but this produced much less realistic results:

...

We posit that the market power of the firms owned by agent K in both product market and labor market (in the form of bargaining power) steadily increases over time for three decades (1980– 2010) and study the transitional dynamics of the model economy.

Since the investor earns strictly positive marginal utility from holding capital, capital accumulation is enhanced far beyond the level in the baseline, increasing the marginal productivity of labor, raising labor demand and lowering the unemployment rate 10 percentage points in 30 years, which is clearly counterfactual. Furthermore, the investment to output ratio increases 18 percent over this period, which contrasts with the 18 percent decline both in the data and in our baseline model. Finally, the greater incentive to accumulate physical capital generates far greater income for wealthy households, creating the rise of credit-to-GDP ratio that greately overshoots the level observed in the data.They also investigated changing the motivations of the agents W:

Another popular narrative behind the rise of credit accumulation is the “keeping-up-with-the-Joneses” preferences for borrowers. This narrative argues that it was the borrowers’ desire to catch up with the lifestyle of the wealthy households, even when their income stagnated, that explains the rise of the household sector leverage ratio. To test this narrative, we modify the preferences of agent W such that the reference point in their external habit is agent K’s consumption level, which is larger than agent W’s consumption level by construction, as agents W are the poorest agents in the model. We find that if keeping-up-with- the-Joneses preferences were the main driver of the credit expansion, credit-to-GDP ratio rises 50 percentage points in 30 years, a substantially higher increase than the one observed in the baseline and also larger than in the data. However, such overshooting helps match the rise in the probability of financial crises. For this reason, we cannot preclude the possibility that the demand factor known as “keeping-up-with-the-Joneses” is one of the factors behind the rises of household leverage and financial instability.If agents W are reluctant to borrow, the returns from the lending by agents K will be lower. So it is in the interests of agents K to (a) increase the prices of essential goods, and/or (b) increase the desire of agents W to purchase inessential goods. This is where advertising comes in, to enhance the “keeping-up-with-the-Joneses” effect. Fortunately, for most Americans the "Joneses" are not the top 5% of agents W who they only ever see on TV, but their slighly better-off neighbors. The altered model probably exaggerates the effect significantly.

So the six bad effects are caused by the increasing market power of agents K, and thus their ability to persuade agents W to borrow from them. What to do to reduce them?

we introduce a redistribution policy to our baseline model that consists of a dividend income tax for agent K and social security spending for agent W. This taxation is non-distortionary in our economy, as the tax rate does not interfere with production decisions. Our results show that a policy of gradually increasing the tax rate from zero to 30 percent over the last 30 years might have been effective in preventing almost 50 percent of buildup in income inequality, credit growth and the increase in the endogenous probability of financial crisis. Since the taxation leaves production efficiency intact, the secular decline in labor share is left intact while the increase in income inequality is substantially subdued. This suggests that carefully designed redistribution policies can be quite effective macroprudential policy tools and more research is warranted in this area."Macroprudential policy" in this context has meant trying to avoid the regular financial crises that mean the taxpayer bails out the banks, and then endures years of "austerity" allegedly to repair the nation's finances so they will be ready for the next crisis. Typically this has involved showering the banks with free money in return for a promise not to indulge in such risky behavior again until enough time has passed for people to forget where their money went. This has worked less well than one might have hoped.

The Federal Reserve authors' radical, socialist suggestion of imposing a tax on agents K and spending the proceeds on stuff that agents W need, like health care, low-cost housing, public transit, clean air and water, unemployment insurance, public education, less murderous police and so on is so not going to happen. But if it did, the authors suggest it just might work:

the taxation does not affect the wealth of nation, it simply breaks the link between the decline of the labor income share and the increase in income inequality. It does so by redistributing income from agents K to agents W with no significant changes in product and labor market equilibrium.In other words, finanicial crises are caused by agents K having so much money sloshing around the financial system compared to the supply of productive investments (restricted by the fact the agents W can't afford to borrow to purchase the products) that the excess money has to be placed in investments so risky that regular crises are guaranteed. The authors' tax diverts the excess to agents W, reducing the risk level because they spend it and thus increase the supply of productive, less risky investments. Neat, huh?

This experiment has important implications for macroprudential policies. Since the GFC, most of the focus of macroprudential policies has been on building the resilience of financial intermediaries by bolstering their capital positions, restricting their risk exposures, and restraining excessive interconnectedness among them. These policies are useful in maintaining financial stability. However, these policies might not address a much more fundamental issue: Why is there so much income “to be intermediated” to begin with? In our framework, the root cause of financial instability is the income inequality driven by changes in market structure and institutional changes that reward the groups at the top of the income distribution. Our experiment suggests that if an important goal for public policy is to limit the probability of a tail event, such as a financial crisis, a powerful macroprudential policy may be a redistribution policy that moderates the rise in income inequality.

Notice that the authors do not propose anti-trust measures; their model continues to increase the market power of agents K. But their redistributive tax ameliorates some of the bad effects of monopolization.

.

Matt Stoller noticed the paper and wrote Monopolization as a Challenge for Both Parties:

Basically, people who produce things for a living don’t make as much money, and people who serve as monopoly middlemen make more money, and then the monopolists lend to the producers, creating a society built on asymmetric power relationships and unstable debt. This paper joins a host of other research coming out in recent years on the perils of concentration.Stoller seems not to have noticed that Cairó & Sim's model is not about reducing monopolization, but about ameliorating its bad effects. But he is right about the awkward politics of reducing it:

For instance, on the labor front, one study showed that concentration costs the average American household $5,000 a year in lost purchasing power. Another showed that since 1980, markups—how much companies charge for products beyond their production costs—have tripled from 21 percent to 61 percent due to growing consolidation. Another revealed that median annual compensation—now only $33,000—would be over $10,000 higher if employers were less concentrated.

Concentration doesn’t just hit wages. Monopolization hits innovation, small business formation, and regional inequality. Hospitals in concentrated markets have higher mortality rates, and concentration of lab capacity in the hands of LabCorp and Quest Diagnostics is likely even behind the Covid testing shortage. The problems induced by monopolization are virtually endless, because fundamentally corporate monopolies are a mechanism to strip people of power and liberty, and people without power and liberty do not flourish.

Monopolization doesn’t fit neatly into any partisan box, because structuring markets is not about taxing and spending; it is about what happens before the tax system starts dealing with profits and revenue. It is about avoiding the need to spend on social welfare by preventing the impoverishment in the first place.

Since the 1970s, American policymakers in both parties have believed in a philosophy in which markets are natural forums where buyers and sellers congregate, ideally free of politics. They stopped paying attention to the details of markets, because doing so was irrelevant to the goal of leaving market actors as remote as possible from the meddling hand of government.

Such a view is profoundly at odds with the bipartisan American anti-monopoly tradition, a tradition in which most merchants and workers from the 18th century onward understood markets and chartered corporations as creatures of public policy organized for the convenience and liberty of the many. This shift fifty years ago had profound consequences. Leaders in both parties have come to believe that larger corporations are generally a good thing, as they reflect more efficient operations instead of reflecting the rise of market power enabled by policy choices.

2 comments:

Paul Krugman explains the contrast between pessimism about the economy and soaring tech stocks in this interesting thread:

"And of course that's a good description of the tech giants whose stocks have soared most. So a good guess is that at least part of what's going on is that long-term pessimism has reduced interest rates, and this has *increased* the value of stocks issued by monopolists"

Sheelah Kolhatkar's Lina Khan’s Battle to Rein in Big Tech is well worth the time it takes to read.

Post a Comment