Crypto is pretty experiential compared to traditional finance, and it's going to get harder for journalists to report on this stuff if they're prohibited from touching it at all (especially as more activity moves into token-gated Discords, DAOs with ownership requirements, etc.)He conveniently ignores that conflict of interest policies prevent journalists owning cryptocurrencies, not experiencing them using the paper's money.

A month earlier Roose had published another masterpiece of credulity entitled Maybe There’s a Use for Crypto After All whose subhead was:

Helium, a wireless network powered by cryptocurrency, hints at the practical promise of decentralized services.Below the fold I compare reality with Roose's naive boosterism.

Roose provides some numbers:

The network is made up of devices called Helium hot spots, gadgets with antennas that can send small amounts of data over long distances using radio frequencies. These hot spots, which cost roughly $500 apieceLets assume that a "few days" is a week. If Roose's hot-spot was representative of the network (he didn't check the sub-Reddit to see if it was) that would mean that the network was paying out $3.5M/week or $182M/year.

...

More than 500,000 Helium hot spots are in use around the world,

...

In the first few days after I plugged it into my Wi-Fi router, it generated about $7 worth of $HNT

|

| Mark Felt (Deep Throat) |

companies like Lime (which has used Helium to keep tabs on its connected scooters) and the Victor mousetrap company (which uses it for a new line of internet-connected traps).

|

| Source |

Of course, money from these corporate customers was not the only money flowing into Helium. Six months earlier, Joanna Ossinger reported that Andreessen-Backed 5G Blockchain Network Raises $111 Million:

The Helium Network, a decentralized peer-to-peer 5G wireless network, has raised $111 million in a token sale led by Andreessen Horowitz.

The transaction was structured as a purchase of Helium’s native token, HNT, and included participation from Ribbit Capital, 10T, Alameda Research and Multicoin Capital, according to a statement.

|

| Source |

A16z’s returns are much worse than Coinbase’s listings overall! This to me smells of insider selling. These should be the best coins there are, given a16z’s access, but instead 100% of those older than 12 months and 90% older than 6 months lag Ethereum.Of course, VC money coming in is good, but a sustainable business can't survive on it. Another source of money coming in is the $500 for each of the hot-spots. They are LoRa gateways, and he could have searched on Amazon to find how much other LoRa gateways cost. I just did, and right now the cheapest I found is $52.99, and a professional one is $193.99. So each hot-spot is generating at least $300 over retail. That's $150M right there, but it isn't a sustainable cash flow either.

So just by using arithmetic and the Internet, Roose could have rapidly found enough information to cast doubt on Helium's sustainability. But he wasn't alone in believing the hype. Seven weeks later, Hannah Miller reported that Crypto Wireless Company Helium Hits Unicorn Status:

Helium Inc., the creator of a blockchain that powers a decentralized wireless network, raised $200 million in a funding round led by Tiger Global Management and Andreessen Horowitz. The startup, valued at $1.2 billion with the latest funding, also said Wednesday that it is changing its name to Nova Labs Inc.At that date, 30th March 2022, HNT was $24.98, down 51% from its peak. Of course, A16Z probably sold around the peak. Even if they had HODL-ed they'd be up 52% but anyone who bought after 10th October 2021 would be under water. On 17th May A16Z published Introducing the 2022 State of Crypto Report describing Helium as:

a grassroots wireless network, is posing the first legitimate, decentralized challenge to entrenched telecom giants.This was impeccable timing. One week earlier, Terra/Luna had collapsed, setting off the "crypto winter". HNT dropped to $8.70, 83% down from the peak. As I write it is $9.30. Amy Castor read A16Z's report and posted A16z’s ‘State of Crypto’ report: A rehash of bad crypto market pitches:

Helium is a utility token ICO scam where you mine HNT to pay for long-range/low-bandwidth wireless connectivity. To start mining, you have to buy $80 worth of gear from a Helium-approved vendor marked up to $600. Some miners report making less than $1 per day. HNT has lost 85% of its value since November.But it doesn't appear that anyone actually followed the money until 26th July, when Liron Shapira's thread (unroll) went viral. He starts with the TL;DR:

.@Helium, often cited as one of the best examples of a Web3 use case, has received $365M of investment led by @a16z.The Generalist explains:

Regular folks have also been convinced to spend $250M buying hotspot nodes, in hopes of earning passive income.

The result? Helium's total revenue is $6.5k/month

To use Helium’s IoT network, customers burn HNT in exchange for Data Credits (DC). This has a deflationary effect on the price of HNT. Data credits maintain a steady value of 1 DC equalling $0.00001. Companies spend Data Credits by transferring data via LongFi and making transactions on the Helium blockchain.Inspired by Shapira's tweet, actual journalists started asking the questions that Roose couldn't be bothered with. First out of the gate was Matt Binder with Web3 darling Helium has bragged about Lime being a client for years. Lime says it isn't true.:

...

Data Credits are used when onboarding a hotspot, asserting a location, and processing a payment. Onboarding hotspots, in particular, is intensive from a Data Credit perspective. Since Helium is onboarding so many new hotspots, this skews results, suggesting greater customer activity than is actually present. Data from The Decentralized Wireless Alliance removes these three uses, demonstrating the size of the Helium economy’s customer demand. By this measure, DC usage was just $6,561 in June.

Since 2019, the decentralized wireless network service, which bills itself as a peer-to-peer network for the Internet of Things, has touted rideshare company Lime as one of its marquee clients, claiming the company uses its service to geolocate rentable escooters. There are numerous mentions of this partnership on its website, along with the presence of Lime's company logo, and in press coverage with various news outlets.Closely followed by Mitchell Clark with Helium says its crypto mesh network is used by Lime and Salesforce — it isn’t:

There's just one problem: That partnership never really existed.

"Beyond an initial test of its product in 2019, Lime has not had, and does not currently have, a relationship with Helium." Lime senior director for corporate communications Russell Murphy said to Mashable.

According to Murphy, there was a "brief test of [Helium's] product that didn’t last beyond a month or two" in the summer of 2019. ... Murphy says that, as a condition of the trial, Lime had requested that its name not be used by Helium in promotional material.

...

According to Lime, The New York Times did not reach out to the company to confirm the partnership.

Now, Salesforce, whose logo appeared on Helium’s website right next to Lime’s, says that it also doesn’t use the technology. “Helium is not a Salesforce partner,” Salesforce spokesperson Ashley Eliasoph told The Verge in an email.Since when probed, Helium's customers seem to evaporate, it isn't suprising that the system's actual revenue from customers is so low. Shapira writes:

Members of the r/helium subreddit have been increasingly vocal about seeing poor Helium returns.So a reasonably skeptical journalist should have discovered that Helium was a typical Web3 company, peddling lies and hype in order to enrich insiders and A16Z.

On average, they spent $400-800 to buy a hotspot. They were expecting $100/month, enough to recoup their costs and enjoy passive income.

Then their earnings dropped to only $20/mo.

These folks maintain false hope of positive ROI. They still don’t realize their share of data-usage revenue isn’t actually $20/month; it’s $0.01/month.

The other $19.99 is a temporary subsidy from investment in growing the network, and speculation on the value of the $HNT token.

Meanwhile, according to Helium network rules, $300M (30M $HNT) per year gets siphoned off by @novalabs_, the corporation behind Helium.

But there's more. A diligent "technology columnist" might have been expected to make at least these four important observations:

- The economics of running a Helium hot-spot are analogous to those of Proof-of-Work mining. In the long term they are both low-margin businesses. There is a limited suopply of rewards for mining blocks or carrying traffic. There is nothing to stop competitors joining in and eroding your margins. PoW mining is profitable only when it takes time for competitors to enter; when the currency is proceeding moon-wards and/or when the supply of mining hardware is restricted. Neither is guaranteed. When they aren't, the lowest-margin miners are forced out. The same will happen to Helium hot-spots.

- Hot-spots compete for the available traffic in their area of coverage. In areas of high hot-spot density, typically urban areas, each will get a small share of the traffic, although if Helium were ever to have a lot of customers there might be quite a bit of it. In rural areas the hot-spot density will be low, so each will get a big share of the available traffic. But there won't be much of it, because there won't be a lot of Things in the Internet there, and because the low hot-spot density will cause gaps in coverage, discouraging use of the network in rural areas.

- Helium hot-spots are often described (not by Helium itself) as forming a mesh network. How does a mesh network deliver traffic? Devices connect to a mesh router. Wikipedia explains what they do:

Mesh routers forward traffic to and from the gateways, which may or may not be connected to the Internet

In other words, packets hop from node to node until they arrive at their destination or a gateway that can forward them onto the Internet. That isn't how Helium works. Each hot-spot (router) is a gateway, so data packets never need to hop between nodes. This makes sense because Helium uses LoRaWAN radio protocols:

Together, LoRa and LoRaWAN define a Low Power, Wide Area (LPWA) networking protocol ... The LoRaWAN data rate ranges from 0.3 kbit/s to 50 kbit/s per channel.

If packets took multiple hops at this low bandwidth, the network performance would be miserable. They don't; after the first hop to the hot-spot they use the much higher bandwidth of the hot-spot owner's ISP's broadband link. Clearly, a maximum of 50K bit/s wouldn't significantly load this link.

-

One thing Helium constantly stresses is "5G":

Source

Helium 5G will be the second major wireless network that the Helium Network supports. If you have a phone that supports 5G, such as an iPhone or Samsung Galaxy, you will soon be able to connect through Hotspots that are powered by the People — you may be getting 5G from your neighbor!

5G cellular networks deliver serious bandwidth:

5G speeds will range from ~50 Mbit/s to over 1,000 Mbit/s (1 Gbit/s).

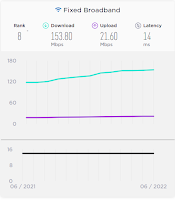

Assuming Helium eventually gets a lot of customers, the impact of connecting a LoRa router to the median US broadband with 150M bit/s down and 20M bit/s up will not be noticeable. But connecting a 5G router will have a big impact on anyone lacking my superb 1G bit/s symmetrical fiber from Sonic (best ISP ever!). Because they don't have a lot of customers, the impact will initially be negligible. But just as competition and the drop in HNT's value led over time to a lot of unhappy hot-spot owners, success with 5G would lead to similar unhappiness.

12 comments:

Not to mention that if 5G Helium ever takes off the ISPs providing the bandwidth to the Helium nodes will likely add a terms-and-conditions denying commercial resale over the cheapest consumer lines (if they don't have these already).

The only way Helium could ever compete with the big carriers is by becoming a mesh network (with Nova labs or other partners footing the bill for backbone connections), or upping the fees for every node to pay for a commercial line.

Networks like Uber which float local ordinances make people think they can get away with sticking it to the private enterprise man. But private enterprises, even those that are common carriers, don't have to sue in court to stop behavior they don't like. They can just drop your service.

So we've got at least two kinds of idiocies: Crypto-idiocy, and Wild West idiocy.

Float = flout. :( Caught it as I was hitting publish.

Tardigrade, you're right about ISPs not liking Helium 5G. Ev en Roose admits that:

"Putting a Helium hot spot in your house might also technically violate your internet service provider’s terms of service, since it involves reselling a portion of your bandwidth."

Also, the Roose article has been updated to admit that:

"Months after this column was published, some of Helium’s partnerships came under scrutiny from crypto skeptics who claimed that the company was claiming affiliations with companies it had no official deals with. A spokesman for Lime said in an email that “beyond an initial test of its product in 2019, Lime has not had, and does not currently have, a relationship with Helium.”"

Of course, this doesn't admit that Roose should have asked Lime about their relationship with Helium, or that Lime had specifically made it a condition of the trial that Helium not claim a relationship.

Helium "5G" is using LTE equipment (like Baicells Nova430H) that has a peak rate of (up to) DL 220Mbit/s, UL2x28 (56) Mbit/s with 2x20MHz spectrum. Hardly exciting.

Less impressive are the carrier partnerships. Dish who to the best of my knowledge hasn't launched a product using Helium's network. Gigsky (who?) that sells a 30 day plan that includes 10 gigs of data for $74.99. Hardly competitive.

In my opinion, we're in a new gold rush where the merchants are again getting rich selling hardware. But this time, only a select few can sell pickaxes and gold pans.

Does Helium take steps to prevent illicit activities from anonymously happening on its routers?

If a miner is held personally liable for something that a user does through a node this will collapse pretty fast. I think there would be legal protection to prevent holding the miner liable, but unless there's an easy way to subpoena information from Nova Labs, having to gather and furnish information to law enforcement would be a major disincentive to running a node. Just as having potentially identifiable information collectable by a random miner you have no idea about would be a disincentive to using the network.

Coffeezilla's The Billion Dollar Network No One Uses is a good YouTube summary of the problems with Helium.

Molly White reports that Helium ditches its blockchain:

"Helium seems to have realized, finally, that blockchains tend to be slow as hell. In a blog post about the change, they wrote that "specific transactions, including Proof-of-Coverage and Data Transfer Accounting, are processed on-chain unnecessarily. This data bottleneck can cause efficiency issues such as device join delays and problems with data packet communications, which bloats the Network and causes slow processing times." They outline their plans to move these portions of the project to a "more traditional large data pipeline"—that is, infrastructure that's actually well-suited to that kind of processing."

Max Chafkin's You Can Give People What They Want. Or You Can Give Them Web3 describes the bigger picture that Helium is a part of:

"Marc Andreessen, the Netscape co-founder and a key backer of Y Combinator startups, appeared on a podcast with Tyler Cowen and was asked to explain an industry he’s pouring billions into. Cowen, like Andreessen, is a libertarian, a critic of “wokeism,” and someone who’s written in praise of cryptocurrencies—in other words, a very sympathetic interviewer. ... But when the topic of crypto came up, Cowen managed to skewer Andreessen by simply and persistently asking him to explain and defend his claim that Web3 would improve, say, podcasting.

Over the course of several minutes, Andreessen struggled to offer a real answer for what was good about Web3, then landed on one that was close to incomprehensible. “Look, it’s injecting economics,” he said. “It’s injecting, at a very fundamental level, internet-native money, internet-native economics, and incentives into a system that simply hasn’t had that.” Cowen declined to press Andreessen on which of the country’s talk radio listeners were clamoring for “internet-native economics,” whatever that meant."

Chafkin contrasts this drive for financialization with the mantra of Paul Graham, founder of Y Combinator, the successful incubator:

"Above all, Graham urged founders to seek out customers from the very beginning and to respond to their needs. “Make something customers actually want,” he said."

It is really hard to find anyone outside the VCs and those they fund who wants financialization of the Web.

Molly White reports that Binance accounting bug involving Helium tokens results in $19 million of erroneous payouts:

"Helium has two different tokens: HNT, which is paid out to people who run Helium hotspots, and MOBILE, which is paid to those maintaining the new Helium 5G network. However, Binance erroneously treated both tokens as HNT within their exchange. As a result, anyone who sent MOBILE to Binance wound up with that same number of HNT tokens in their wallet—a big benefit, given that HTN has traded between $4 and $7 this past month, and MOBILE is not yet easily tradable.

Binance distributed around 4.8 million HNT before discovering and patching the bug, valued at around $19 million."

10 months ago HNT hit $51.20 - it is now at $4.35, down 91.5% from the peak. Yet another of A16Z's list and dump schemes.

David Jeans and Sarah Emerson report that Helium, The A16Z-Backed Crypto Unicorn, Spars With Binance Over Delisting:

"A token created by Helium, a much-hyped crypto project hailed as one of the best use cases of Web3 technology, will be partially delisted from major cryptocurrency exchange Binance amid reports of poor revenue and misleading marketing at its parent company, as well as the network’s abandonment of its native blockchain last month.

In a blog post Thursday, Binance said that it would cease trading Helium Network Tokens, or HNT, with multiple trading pairs over the next week, effectively preventing token holders from exchanging HNT for Bitcoin or other tokens. Binance “strongly advised” people to close out their positions, or else it would “conduct an automatic settlement and cancel all pending orders” relating to HNT and its trading pairs on October 12."

Helium's HNT is currently trading trading around $$2.53, down from a peak of $51.15 exactly a year ago. That's a 95% drop in a year.

Yet again Kevin Roose has been acting as the New York Times' technology stenographer. Ed Zitron has the receipts in The Phony Comforts of AI Optimism:

"You see, optimism is easy. All you have to do is say "I trust these people to do the thing they'll do" and choose to take a "cautiously optimistic" (to use Roose's terminology) view on whatever it is that's put in front of you. Optimism allows you to think exactly as hard as you'd like to, using that big, fancy brain of yours to make up superficially intellectually-backed rationalizations about why something is the future, and because you're writing at a big media outlet, you can just say whatever and people will believe you because you're ostensibly someone who knows what they're talking about."

Post a Comment