Permissionless blockchains require an inflow of speculative funds at an average rate greater than the current rate of mining rewards if the "price" is not to collapse. To maintain Bitcoin's price at $4K requires an inflow of $300K/hour.I found it hard to believe that this much actual money would flow in, but since then Bitcoin's "price" hasn't dropped below $4K, so I was wrong. Caution — I am only an amateur economist, and what follows below the fold is my attempt to make sense of what is going on.

First, why did I write that? The economic argument is that, because there is a low barrier to entry for new competitors, margins for cryptocurrency miners are low. So the bulk of their income in terms of mining rewards has to flow out of the system in "fiat" currency to pay for their expenses such as power and hardware. These cannot be paid in cryptocurrencies. At the time, the Bitcoin block reward was 12.5BTC/block, or 75BTC/hour. At $4K/BTC this was $300K/hour, so on average 300K USD/hour had to flow in from speculators if the system was not to run out of USD.

|

| Source |

Second, lets set the context for what has happened in cryptocurrencies in the last year.

|

| Source |

|

| Source |

|

| Source |

|

| Source |

Tether (USDT) is a "stablecoin", intended to maintain a stable price of 1USD = 1USDT. Initially, Tether claimed that it maintained a stable "price" because every USDT was backed by an actual USD in a bank account. Does that mean that investors transferred around sixteen billion US dollars into Tether's bank account in the past year? No-one believes that. There has never been an audit of Tether to confirm what is backing USDT. Tether themselves admitted to the New York Attorney General in October 2018 that:

the $2.8 billion worth of tethers are only 74% backed:If USDT isn't backed by USD, what is backing it, and is 1USDT really worth 1USD?

Tether has cash and cash equivalents (short term securities) on hand totaling approximately $2.1 billion, representing approximately 74 percent of the current outstanding tethers.

|

| Source |

Tether transfers newly created USDT to an exchange, where one of two things can happen to it:

- It can be used to buy USD or an equivalent "fiat" currency. But only a few exchanges allow this. For example, Coinbase, the leading regulated exchange, will not provide this "fiat off-ramp":

Please note that Coinbase does not support USDT — do not send it to your Bitcoin account on Coinbase.

Because of USDT's history and reputation, exchanges that do offer a "fiat off-ramp" are taking a significant risk, so they will impose a spread; the holder will get less than $1. Why would you send $1 to Tether to get less than $1 back? - It can be used to buy another cryptocurrency, such as Bitcoin (BTC) or Ethereum (ETH), increasing demand for that cryptocurrency and thus increasing its price.

For simplicity of explanation, lets imagine a world in which there are only USD, USDT and BTC. In this world some proportion of the backing for USDT is USD and some is BTC.

Someone sends USD to Tether. Why would they do that? They don't want USDT as a store of value, because they already have USD, which is obviously a better store of value than USDT. They want USDT in order to buy BTC. Tether adds the USD to the backing for USDT, and issues the corresponding number of USDT, which are used to buy BTC. This pushes the "price" of BTC up, which increases the "value" of the part of the backing for USDT that is BTC. So Tether issues the corresponding amount of USDT, which is used to buy BTC. This pushes the "price" of BTC up, which increases the "value" of the part of the backing for USDT that is BTC. ...

Tether has a magic "money" pump, creating USDT out of thin air. But there is a risk. Suppose for some reason the "price" of BTC goes down, which reduces the "value" of the backing for USDT. Now there are more USDT in circulation than are backed. So Tether must buy some USDT back. They don't want to spend USD for this, because they know that USD are a better store of value than USDT created out of thin air. So they need to sell BTC to get USDT. This pushes the "price" of BTC down, which reduces the "value" of the part of the backing for USDT that is BTC. So Tether needs to buy more USDT for BTC, which pushes the "price" of BTC down. ...

The magic "money" pump has gone into reverse, destroying the USDT that were created out of thin air. Tether obviously wants to prevent this happening, so in our imaginary world what we would expect to see is that whenever the "price" of BTC goes down, Tether supplies the market with USDT, which are used to buy BTC, pushing the price back up. Over time, the BTC "price" would generally go up, keeping everybody happy. But there is a second-order effect. Over time, the proportion of the backing for USDT that is BTC would go up too, because each USD that enters the backing creates R>1 USD worth of "value" of the BTC part of the backing. And, over time, this effect grows because the greater the proportion of BTC in the backing, the greater R becomes.

|

| Source |

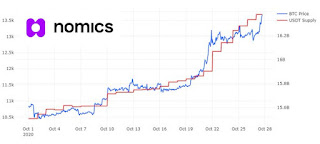

- The "price" of BTC correlated with the number of USDT in circulation. The graph shows this in the real world.

- Both the "price" of BTC and the number of USDT in circulation growing exponentially. The graph shows this in the real world.

- Spikes in the number of USDT in circulation following falls in the "price" of BTC. Is Bitcoin Really Untethered? by John Griffin and Amit Shams shows that:

Rather than demand from cash investors, these patterns are most consistent with the supply‐based hypothesis of unbacked digital money inflating cryptocurrency prices.

Their paper was originally published in 2018 and updated in 2019 and 2020. - Tether being extremely reluctant to be audited because that would reveal how little money and how much "money" was supporting the BTC "price".

Apart from the work of Griffin and Shams, there is a whole literature pointing out the implausibility of Tether's story. Here are a few highlights:

- JP Konig's 18 things about Tether stablecoins

- Social Capital's series explaining Tether and the "stablecoin" scam:

- Price manipulation in the Bitcoin ecosystem by Neil Gandal et al

- Cryptocurrency Pump-and-Dump Schemes by Tao Li et al

- Patrick McKenzie's Tether: The Story So Far:

A friend of mine, who works in finance, asked me to explain what Tether was.

Short version: Tether is the internal accounting system for the largest fraud since Madoff.

Massive frauds suffer from a "Wile E. Coyote" effect. Because they are "too big to fail" there is a long time between the revelation that they are frauds, and the final collapse. It is hard for people to believe that, despite numbers in the billions, there is no there there. Both investors and regulators get caught up in the excitement and become invested in keeping the bubble inflated by either attacking or ignoring negative news. For example, we saw this in the Wirecard scandal:

BaFin conducted multiple investigations against journalists and short sellers because of alleged market manipulation, in response to negative media reporting of Wirecard. ... Critics cite the German regulator, press and investor community's tendency to rally around Wirecard against what they perceive as unfair attack. ... After initially defending BaFin's actions, its president Felix Hufeld later admitted the Wirecard Scandal is a "complete disaster".Similarly, the cryptocurrency world has a long history of both attacking and ignoring realistic critiques. An example of ignoring is the DAO:

The Decentralized Autonomous Organization (The DAO) was released on 30th April 2016, but on 27th May 2016 Dino Mark, Vlad Zamfir, and Emin Gün Sirer posted A Call for a Temporary Moratorium on The DAO, pointing out some of its vulnerabilities; it was ignored. Three weeks later, when The DAO contained about 10% of all the Ether in circulation, a combination of these vulnerabilities was used to steal its contents.

|

| Source |

David Gerard points out the obvious in Tether is “too big to fail” — the entire crypto industry utterly depends on it:

The purpose of the crypto industry, and all its little service sub-industries, is to generate a narrative that will maintain and enhance the flow of actual dollars from suckers, and keep the party going.Gerard links to Bryce Weiner's Hopes, Expectations, Black Holes, and Revelations — or How I Learned To Stop Worrying and Love Tether which starts from the incident in April of 2018 when Bitfinex, the cryptocurrency exchange behind Tether, encountered a serious problem:

Increasing quantities of tethers are required to make this happen. We just topped twenty billion alleged dollars’ worth of tethers, sixteen billion of those just since March 2020. If you think this is sustainable, you’re a fool.

the wildcat bank backing Tether was raided by Interpol for laundering of criminally obtained assets to the tune of about $850,000,000. The percentage of that sum which was actually Bitfinex is a matter of some debate but there’s no sufficient reason not to think it was all theirs.At the time, USDT's "market cap" was around $2.3B, so assuming Tether was actually backed by USD at that point, it lost 37% of its backing. This was a significant problem, more than enough to motivate shenanigans.

...

the nature of the problem also presented a solution: instead of backing Tether in actual dollars, stuff a bunch of cryptocurrency in a basket to the valuation of the cash that got seized and viola! A black hole is successfully filled with a black hole, creating a stable asset.

Weiner goes on to provide a detailed explanation, and argue that Tether is impossible to shut down. He may be right, but it may be possible to effectively eliminate the "fiat off-ramp", thus completely detaching USDT and USD. This would make it clear that "prices" expressed in USDT are imaginary, not the same as prices expressed in USD.

|

| Source |

We saw about 300 million Tethers being lined up on Binance and Huobi in the week previously. These were then deployed en masse.See Cryptocurrency Pump-and-Dump Schemes by Tao Li, Donghwa Shin and Baolian Wang.

You can see the pump starting at 13:38 UTC on 16 December. BTC was $20,420.00 on Coinbase at 13:45 UTC. Notice the very long candles, as bots set to sell at $20,000 sell directly into the pump.

|

| Source |

Lots of people deposited stablecoins to exchanges 7 mins before breaking $20k.Note that "7 mins" is about one Bitcoin block time, and by "exchange users" he means "addresses — it could have been a pre-programmed "smart contract".

Price is all about consensus. I guess the sentiment turned around to buy $BTC at that time.

...

ETH block interval is 10-20 seconds.

This chart means 127 exchange users worldwide were trying to deposit #stablecoins in a single block — 10 seconds.

[1] David Gerard points out that:

USDC loudly touts claims that it’s well-regulated, and implies that it’s audited. But USDC is not audited — accountants Grant Thornton sign a monthly attestation that Centre have told them particular things, and that the paperwork shows the right numbers.

17 comments:

XRP, the third-largest unstablecoin by "market cap", has lost almost 40% of its value over the last 7 days. This might have something to do with the SEC suing Ripple Labs, who control the centralized cryptocurrency, claiming that XRP is an unregistered security.

The SEC's argument, bolstered with copious statements by the founders, is at heart that the founders pre-mined and kept vast amounts of XRP, which they then pump and sell:

"Defendants continue to hold substantial amounts of XRP and — with no registration statement in effect — can continue to monetize their XRP while using the information asymmetry they created in the market for their own gain, creating substantial risk to investors."

David Gerard points out that Ripple Labs knew they should have registered:

"Ripple received legal advice in February and October 2012 that XRP could constitute an “investment contract,” thus making it a security under the Howey test — particularly if Ripple promoted XRP as an investment. The lawyers advised Ripple to contact the SEC for clarification before proceeding.

Ripple went ahead anyway, without SEC advice — and raised “at least $1.38 billion” selling XRP from 2013 to the present day, promoting it as an investment all the while"

Izabella Kaminska notes that other cryptocurrencies may have similar legal issues:

"This may concern other cryptocurrencies such as Ethereum and Eos, which unlike Bitcoin were pre-sold to the public in a similar fashion"

Izabella Kaminska has the highlights of the SEC filing against Ripple Labs. They are really damning.

David Gerard points to this transaction and asks:

"Don’t you hate it when you send $1.18 in BTC with a fee of $82,000? I guess they can call Bitcoin Customer Service and get it sorted out! It’s not clear if this transaction ever showed up in the mempool — or if it was the miner putting it directly into the block, and doing some Bitcoin-laundering."

The magic "money" pump is working overtime to make Santa gifts for the children:

"Tether has issued 700 million tethers in just the past few days, 400 million of those just today. The market pumpers seem to have been blindsided by the SEC suit against Ripple, and are trying frantically to avert a Christmas crash. I’m sure there’s a ton of Institutional Investors going all-out on Christmas Eve."

Amy Castor collected predictions for 2021 from cryptocurrency skeptics in Nocoiner predictions: 2021 will be a year of comedy gold. They're worth reading. For example:

"Since 2018, the New York Attorney General has been investigating Tether and its sister company, crypto exchange Bitfinex, for fraud. Over the summer, the Supreme Court ruled that the companies need to hand over their financial records to show once and for all just how much money really is underlying the tethers they keep printing. The NYAG said Bitfinex/Tether have agreed to do so by Jan. 15."

David Gerard expanded on his predictions in 2021 in crypto and blockchain: your 100% reliable guide to the future, including:

"We’re currently in the throes of a completely fake Bitcoin bubble. This is fueled by billions of tethers, backed by loans, or maybe bitcoins, or maybe hot air. Large holders are spending corporate money on bitcoins, fundamentally to promote the value of their own holdings.

Retail hasn’t shown up — there’s a lack of actual dollars in the exchange system. One 150 BTC sale last night (2 January) dropped the price $3,000.

If 150 BTC crashes the price, then almost nobody will be able to get out without massive losses. The dollars don’t appear to exist when tested."

In Parasitic Stablecoins Time Swanson focuses in exhaustive detail on the dependence of stablecoins on the banking system:

"This post will go through some of the background for what commercial bank-backed stablecoins are, the loopholes that the issuers try to reside in, how reliant the greater cryptocurrency world is dependent on U.S. and E.U. commercial banks, and how the principles for financial market structures, otherwise known as PFMIs, are being ignored"

Cas Piancy's brief history of Tether entitled A TL; DR for Tether and IMF researcher John Kiff's Kiffmeister's #Fintech Daily Digest (01/09/2021) are both worth reading for views on Tether.

Further regulation of cryptocurrency on- and off-ramps is announced by FinCEN in The Financial Crimes Enforcement Network Proposes Rule Aimed at Closing Anti-Money Laundering Regulatory Gaps for Certain Convertible Virtual Currency and Digital Asset Transactions:

"The proposed rule complements existing BSA requirements applicable to banks and MSBs by proposing to add reporting requirements for CVC and LTDA transactions exceeding $10,000 in value. Pursuant to the proposed rule, banks and MSBs will have 15 days from the date on which a reportable transaction occurs to file a report with FinCEN. Further, this proposed rule would require banks and MSBs to keep records of a customer’s CVC or LTDA transactions and counterparties, including verifying the identity of their customers, if a counterparty uses an unhosted or otherwise covered wallet and the transaction is greater than $3,000."

Amy Castor has transcribed an interview with Paolo Ardino and Stuart Hoegner of Tether. Hoegner is their General Counsel, and he said:

"We were very clear last summer in court that part of it is in bitcoin. And if nothing else, there are transaction fees that need to be paid on the Omni Layer. So bitcoin was and is needed to pay for those transactions, so that shouldn’t come as a surprise to anyone. And we don’t presently comment on our asset makeup overall as a general manner, but we are contemplating starting a process of providing updates on that on the website in this year, in 2021."

So my speculation in this post is confirmed. They do have a magic "money" machine.

There's nothing new under the sun. David Gerard's Stablecoins through history — Michigan Bank Commissioners report, 1839 starts:

"A “stablecoin” is a token that a company issues, claiming that the token is backed by currency or assets held in a reserve. The token is usually redeemable in theory — and sometimes in practice.

Stablecoins are a venerable and well-respected part of the history of US banking! Previously, the issuers were called “wildcat banks,” and the tokens were pieces of paper.

The wildcat banking era, more politely called the “free banking era,” ran from 1837 to 1863. Banks at this time were free of federal regulation — they could launch just under state regulation.

Under the gold standard in operation at the time, these state banks could issue notes, backed by specie — gold or silver — held in reserve. The quality of these reserves could be a matter of some dispute.

The wildcat banks didn’t work out so well. The National Bank Act was passed in 1863, establishing the United States National Banking System and the Office of the Comptroller of the Currency — and taking away the power of state banks to issue paper notes."

Go read the whole post - the parallels with cryptocurrencies are striking.

In Tether publishes … two pie charts of its reserves, David Gerard analyses the uninformative "information" Tether published about its reserves:

"I’m analysing Tether’s numbers on the basis that they aren’t just made up, and mean something in any conventional sense. It’s reasonable to doubt this — Tether’s been caught directly lying before — but previous Tether numbers have tended to have some sort of justification, if only a laughably flimsy one that meets no accepted accounting standards."

And Amy Castor piles on in Tether’s first breakdown of reserves consists of two silly pie charts including this gem:

"Specifically, this is a breakdown of the composition of Tether’s reserves on March 31, 2021, when Tether had roughly 41.7 billion tethers in circulation. (As of this writing, Tether now has nearly 58 billion tethers in circulation.)"

So Tether is pumping the money supply at nearly $3B a week!

Jemima Kelley is also all over Tether's "transparency" in Tether says its reserves are backed by cash to the tune of . . . 2.9%:

"It’s almost like Tether thinks it is some kind of bank, isn’t it?

Well, kind of. In the 2019 affadavit, Hoegner pointed out that commercial banks operate under a similar “fractional reserve” system, and that this was “hardly a novel concept”. But 2.9 per cent is really quite the fraction isn’t it? And the difference here, of course, is that commercial banks are subject to stringent regulations and thorough independent audits, neither of which apply to Tether."

Frances Coppola makes an important point in Tether’s smoke and mirrors. Tether's terms of service place them under no obligation to redeem Tethers for fiat or indeed for anything at all:

"Tether reserves the right to delay the redemption or withdrawal of Tether Tokens if such delay is necessitated by the illiquidity or unavailability or loss of any Reserves held by Tether to back to Tether Tokens, and Tether reserves the right to redeem Tether Tokens by in-kind redemptions of securities and other assets held in the Reserves."

Coppola points out that:

"if Tether is simply going to refuse redemption requests or offer people tokens it has just invented instead of fiat currency, it wouldn’t matter if the entire asset base was junk, since it will never have any significant need for cash.

So whether Tether’s "reserves" are cash equivalents doesn't matter. But what does matter is capital.

For banks, funds and other financial institutions, capital is the difference between assets and liabilities. It is the cushion that can absorb losses from asset price falls, whether because of fire sales to raise cash for redemption requests or simply from adverse market movements or creditor defaults.

The accountant's attestations reveal that Tether has very little capital. The gap between assets and liabilities is paper-thin: on 31st March 2021 (pdf), for example, it was 0.36% of total consolidated assets, on a balance sheet of more than $40bn in size. Stablecoin holders are thus seriously exposed to the risk that asset values will fall sufficiently for the par peg to USD to break – what money market funds call “breaking the buck”."

Go read the whole post.

Simon Sharwood reports on an actual use case for Tether in Hong Kong busts $150m crypto money-laundering ring:

"Hong Kong’s Customs and Excise Department yesterday arrested four men over alleged money-laundering using cryptocurrency.

The Department says it detected multiple transactions in a coin named “Tether”, with value bouncing between a crypto exchange, local banks, another crypto exchange, and banks in Singapore.

HK$1.2bn (US$155m) is alleged to have been laundered by the four suspects, in what authorities said was the first case of crypto-laundering detected in the Special Administrative Region (SAR). The launderers were busy: multiple daily transactions of HK$20m were sometimes detected as they went about their scheme, which ran from early 2020 to May 2021."

Fais Kahn has two posts, Crypto and the infinite ladder: what if Tether is fake? and Bitcoin's end: Tether, Binance and the white swans that could bring it all down about the Binance/Tether nexus that are well worth reading. He concludes:

"Everything around Binance and Tether is murky, even as these entities two dominate the crypto world. Tether redemptions are accelerating, and Binance is in trouble, but why some of these things are happening is guesswork. And what happens if something happens to one of those two? We’re entering some uncharted territory. But if things get weird, don’t say no one saw it coming."

Taming Wildcat Stablecoins by Gary Gorton and Jeffery Zhang analyzes stablecoins with a historical perspective, starting with the 19th century "free banking" era in the US. Zhang is a lawyer at the Fed. Izabella Kaminska summarizes their argument in Gorton turns his attention to stablecoins,and points out that:

"Gary Gorton has gained a reputation for being something of an experts’ expert on financial systems. Despite being an academic, this is in large part due to what might be described as his practitioner’s take on many key issues.

The Yale School of Management professor is, for example, best known for a highly respected (albeit still relatively obscure) theory about the role played in bank runs by information-sensitive assets."

Tom Schoenberg, Matt Robinson, and Zeke Faux report that Tether Executives Said to Face Criminal Probe Into Bank Fraud:

"A U.S. probe into Tether is homing in on whether executives behind the digital token committed bank fraud, a potential criminal case that would have broad implications for the cryptocurrency market.

...

Specifically, federal prosecutors are scrutinizing whether Tether concealed from banks that transactions were linked to crypto, said three people with direct knowledge of the matter who asked not to be named because the probe is confidential."

...

Federal prosecutors have been circling Tether since at least 2018. In recent months, they sent letters to individuals alerting them that they’re targets of the investigation, one of the people said."

Post a Comment