First is Why some charities are rethinking cryptocurrency donations by Noam Cohen:

The Giving Block, a company that provides back-end support to more than 1,000 charities accepting crypto-donations, reported donations last year with an exchange value of nearly $70 million, up from $4.2 million in 2020, a rate of growth much higher than the increase in price of the currency itself.It isn't just charities that are finding cryptocurrencies less popular than the media would have you believe. Game publishers were salivating at the prospect of selling NFTs purporting to represent in-game items. Their customer's reactions led to headlines such as Roller derby community resoundingly rejects NFT project, MeUndies cancels its NFT underwear plans and sells its Bored Ape after community backlash, S.T.A.L.K.E.R. 2 developer quickly cancels NFT plans after fan outcry, Sega cites fan backlash in surprisingly cautious take on gaming NFTs, Ubisoft’s first NFT experiment was a dumpster fire, and so on.

...

Yet as fast as crypto-donations have come on the scene, a determined resistance has emerged within some charities. The resisters see digital currencies as a predatory scheme in which newer investors’ money is used to enrich earlier, wealthier investors; additionally, they point to crypto’s reliance on tremendous amounts of computing power and electricity to verify transactions, contributing to global warming. Accepting a crypto gift, from this perspective, means endorsing a new financial system even more unjust and destructive than the old one.

Back in 2019, Greenpeace was among the first organizations to reject such donations as antithetical to its mission. This January, the Mozilla Foundation, which supports the open-source Firefox Web browser, announced that it was pausing crypto-donations while it reviewed their “impact on our climate change commitments.” The foundation acted after an innocuous tweet from an official Mozilla account encouraging crypto-donations received a profanity-laced reply from Jamie Zawinski, a Mozilla founder. Zawinski’s tweet, which was liked more than 20,000 times, did not mince words: “Everyone involved in the project should be witheringly ashamed of this decision to partner with planet-incinerating Ponzi grifters.” In an email, he elaborated briefly: “Any organization that purports to be about long term thinking, the open web, or that has any kind of climate-related goals cannot, un-hypocritically, have *anything* to do with cryptocurrencies.”

Second, Cryptocurrency could help governments and businesses spy on us by Eswar Prasad points out it isn't just committing crimes on a public blockchain that isn't a great idea, but spending money in general:

It turns out that the cryptocurrency does not, in fact, guarantee anonymity. Users’ digital identities can, with some effort, be connected to their real identities. Moreover, in an ultimate irony, the revolution that bitcoin started might end up destroying whatever vestiges of privacy are left in modern financial markets. As the technology goes mainstream, it threatens to give big corporations and government a better view into our financial lives and greater control over how we spend our money.This is especially true in the case of Central Bank Digital Currencies:

Offshoots of bitcoin’s technology are also setting the stage for central banks to issue their own digital currencies. The central banks of China, Japan and Sweden are already experimenting with this. The U.S. Federal Reserve has been slower but is now considering options for a digital dollar. That would provide a free, convenient digital payment system for the masses, even those without a bank account or a credit card. Tax-dodging and counterfeiting would become harder, and the use of currency for money laundering, terrorism financing and other nefarious activities would be curtailed.Alas, the highly transmissible Blockchain Gaslighting has infected even the reasonable Prasad (my emphasis):

But these advantages have strings attached. Electronic transactions leave a digital trail that cannot easily be erased. Using cryptographic tools, the identities of transacting parties using electronic money can be masked, but a central bank would always have the option of unraveling those identities if it suspected that its money was being used for illicit purposes. Even with privacy protections in place, transactions using a central bank’s digital currency would ultimately be auditable and traceable.

Bitcoin’s blockchain technology will help in creating better digital payment systems, automating a broad range of transactions and democratizing finance. But in an ironic twist, the true (and potentially dark) legacy of bitcoin might be the erosion of confidentiality, the broader prevalence of government-managed payment systems, and a greater intrusion of big business and government in financial systems — and in the functioning of society.

|

| Source |

Binance is not just an exchange where people can buy and sell crypto. The company, whose valuation some employees claim may be as high as $300 billion, is practically its own vertically integrated crypto economy, offering crypto loans and the widest selection of tokens. If that weren’t enough, Binance itself trades on its own exchange. In traditional markets, this kind of arrangement would never be allowed, as the conflicts of interest — and potential for market manipulation — are glaring. Imagine the New York Stock Exchange or Nasdaq taking positions on different sides of trades it facilitates. No financial regulator would allow it, for obvious reasons.This was when the outage ocurred:

...

The lack of government oversight, combined with the conflicts, will become more of an issue as cryptocurrencies grow increasingly mainstream, advertised on every possible medium and traded in retirement portfolios. Even relatively savvy investors stand to lose everything on risks they could never take in another circumstance.

This was the situation Francis Kim had put himself into when he took out a bitcoin short position on Binance. Whether by luck or skill, his bet soon proved right — or seemed to. In the first few weeks of May, the price of bitcoin fell from $58,000 per coin to $40,000. On May 19, it collapsed, with the slide even steeper on Binance’s trading platform (crypto prices can vary slightly among platforms, offering arbitrage opportunities for sophisticated traders). As Kim watched on his phone screen, the price per bitcoin fell in minutes from $38,000 to $30,000. And as the market tanked, his short position exploded, its value growing from $30,000 to $171,000. Time to cash out: All he had to do was click a button on the Binance app to lock in his gains.

By the time the Binance app was back up and running some hours later, it was too late for both Kim and Ahmed. While Ahmed’s position had been liquidated because the app wasn’t working and the price was plunging, destroying the value of his holdings, for Kim, something even stranger happened. Although he was correct in his bet, and his short position was worth $171,000 when bitcoin hit its lowest price that day, by the time the Binance app was usable again, the price had bounced back to near its original level. Rather than being up nearly $150,000, all his profits had evaporated.The article concludes:

...

Kim and Ahmed soon learned that they weren’t alone — and that strange outages like this one weren’t atypical for Binance. On Twitter and Reddit, horror stories abounded, with at least one individual claiming a loss of $30 million. On Discord, an ad hoc support group swelled to more than 700 people. Some of the traders, including Kim, had dealt fruitlessly with Binance’s customer service, which offered them a small percentage of their losses.

...

With Binance refusing to make them whole, the Discord group began to plan a class-action lawsuit, which has the potential to win relief for a broad swath of aggrieved customers. Kim and Ahmed connected with Liti Capital, a Switzerland-based blockchain private-equity firm — essentially, a litigation finance firm that issues its own cryptocurrency and tries to incorporate public decision-making into which cases it takes on. Liti staked $5 million to support the suit, which is now being led by international law firm White & Case. Binance’s user agreement requires litigious customers to submit to arbitration at the Hong Kong International Arbitration Center, where a minimum cost of more than $50,000 for the services of the court and a qualified arbiter is prohibitive for traders who lost a few hundred or thousand dollars. By pooling millionaire day traders with mom-and-pop claimants, and using the backing of Liti Capital, White & Case got around that hurdle.

Despite its distributed — and still mostly unaccountable — corporate structure, Binance probably faces significant legal head winds. Its decline as the world’s preeminent crypto exchange could be as steep as its rise. For many crypto traders, high risk is an accepted part of the game, and an exchange or DeFi protocol is only as good as the profit opportunities it presents. Should Binance fall, another unregulated trading platform might quickly take its place.The go-to source for information on Binance's role in the cryptocurrency ecosystem is Prof. Carol Alexander's blog, in particular her examination of the May 19th outage in Binance’s Insurance Fund:

It’s hard to see how this “democratization of finance,” as it’s often called, leads to a fairer economy rather than a more chaotic one, with a vast gulf between winners and losers. The liberatory rhetoric and experimental economics of crypto are alluring, but they seem to amplify many of the worst qualities of our existing capitalist system while privileging a minority group of early adopters and well-connected insiders. Right now, Binance is in the vanguard of this attention-grabbing, money-churning industry, but perhaps its example should be taken as a warning.

How insufficient insurance funds might explain the outage of Binance’s futures platform on May 19 and the potentially toxic relationship between Binance and Tether.Fourth, The 1% Tax That Has India’s Crypto Industry Predicting Chaos by Sidhartha Shukla:

When India’s government unveiled a plan to tax crypto assets in February, it was the 30% rate on income from digital-asset investments that grabbed headlines. But it’s a different levy that has the industry warning of a potentially destabilizing liquidity crunch.Having had their demands for "regulatory clarity" met, the crypto-bros are naturally outraged:

Along with the capital gains charge, the finance ministry announced a 1% tax deductible at source, or TDS, on all digital-asset transfers above a certain size, starting July 1. No other country imposes such a tax on crypto, according to Anoush Bhasin, founder of crypto asset tax advisory firm Quagmire Consulting.

Crypto-exchange executives, lawyers and tax analysts warn that the TDS will suck liquidity out of the market by forcing high-frequency traders to dramatically curtail their trading. Combined with the government’s decision not to permit offsetting of trading losses in digital assets, it threatens to accelerate an exodus of crypto companies and workers from India, they say.They say that like its a bad thing.

Fifth, there was a related story on looming "regulatory clarity", Crypto Platforms Ask for Rules But Have a Favorite Watchdog by Robert Schmidt and Allyson Versprille. They report on the massive lobbying effort by Sam Bankman-Fried, CEO of the FTX exchange, to avoid regulation by the SEC:

He’s arguing for a bigger role for the U.S. Commodity Futures Trading Commission. The relatively small agency monitors futures contracts in basic goods such as crude oil, corn, and pork, as well as financial derivatives such as interest-rate swaps. It also oversees U.S. futures and options contracts on the popular cryptocurrencies Bitcoin and Ether. A U.S. affiliate of the Bahamas-based FTX offers such crypto derivatives, so part of its business is already under the CFTC’s purview.Why the CFTC not the SEC?:

the SEC is the much larger agency and has more experience protecting retail investors. It has about 4,500 full-time workers; the CFTC has about 700. The SEC’s $1.9 billion budget dwarfs the CFTC’s $300 million.The last thing the exchanges want is protection for retail investors. The professionals need a continuous inflow of sheep to be shorn, which is why everwhere you look you see advertisements extolling the "benefits" of throwing your money into the voracious mouths of the sharks.

Doomberg's A Spot of Bother for Bitcoin is an excellent explanation of the CFTC/SEC spat:

Because of the CFTC’s support and its desire to provide regulatory clarity, there exists in the US today a vibrant futures market in Bitcoin. There are even several Bitcoin futures ETFs that trade on the stock market, including the popular ProShares Bitcoin Strategy ETF (NYSE Arca, Symbol: BITO), which has over $1 billion in assets under management. Since its launch last fall, BITO trades with a 95%+ correlation to the spot price of Bitcoin, giving regular investors the opportunity to speculate in their favorite digital commodity using their brokerage accounts, like they would any other stock.My Bitcoin vs. Madoff uses a model shared with Doomberg's earlier Dollars Ex Machina:

Missing from the suite of US investor options is a direct Bitcoin spot market ETF, and getting one approved has been a high-priority goal of the heavy hitters in the Bitcoin community for many years. Given the existence of ETFs like BITO, why is this an urgent issue for them and why doesn’t one already exist? The answer to both is revealed in understanding the nature of the Bitcoin Ponzi scheme. With SEC Chair Gary Gensler steadfastly declining Bitcoin spot ETF applications almost as fast as they come in, he is signaling what he already understands.

We distinctly recall drawing two circles on a piece of paper. In the circle on the left, we wrote ‘real economy,’ while in the circle on the right we wrote ‘crypto universe.’ We drew two pipes between the circles – one flowing into the crypto universe and the other flowing back to the real economy – and labeled both pipes with ‘fiat currencies.’ While we understood how fiat currencies from investors could flow in, we failed to grasp what could be occurring within the crypto universe that would create more fiat currency for investors to take out at a later date.Doomberg uses this model in their explanation:

While Bitcoin futures contracts reference the price of Bitcoin and can be used to speculate on the commodity, they are settled in cash.The winners need an outflow of fiat to bank their winnings and buy the Lambo. Thus they need an even bigger inflow of potential losers, and the way to get them is to sucker them into buying Bitcoin ETFs. Gensler's SEC understands this, as their rejection of a recent proposed ETF shows:

...

When an investor takes a position in a futures contract, they deposit US dollars in their account as margin. So too does the investor on the other side of the trade. As the price of Bitcoin fluctuates, one side wins and the other side loses, but at no time do US dollars leave the real economy as a direct consequence of this trade. The winning side collects more US dollars, and the losing side ends up with less, but the direct flow of fiat never enters the crypto universe.

Now consider the flow of fiat for Bitcoin spot ETFs. These products are designed to buy and hold Bitcoin directly, injecting much-needed US dollars into the crypto universe. As long as funds flow into spot ETFs faster than they are redeemed, the net effect provides US dollar exit liquidity to those looking to cash out their Bitcoin. And therein lies the critical difference between the two products, and why, in our estimation, Gensler is blocking these applications.

does not sufficiently contest the presence of possible sources of fraud and manipulation in the bitcoin spot market generally that the Commission has raised in previous orders. Such possible sources have included (1) ‘wash’ trading, (2) persons with a dominant position in bitcoin manipulating bitcoin pricing, (3) hacking of the bitcoin network and trading platforms, (4) malicious control of the bitcoin network, (5) trading based on material, non-public information, including the dissemination of false and misleading information, (6) manipulative activity involving the purported “stablecoin” Tether (USDT), and (7) fraud and manipulation at bitcoin trading platforms.Sixth, there was reporting about last week's world record $630M DeFi heist, including Who Hurts Most in $600 Million Axie Heist? ‘Not the Venture Capitalists’ by Kristine Servando, Emily Nicolle, and Jamille Tran:

While players can still steer their blob-like Axie creatures around the game’s virtual world of Lunacia in search of Smooth Love Potion (SLP) and Axie (AXS) tokens, one crucial aspect is now missing: The ability to move some crypto earned in the game out of the virtual world and into other digital currencies or fiat, and vice versa.Unable to greenwash exploiting "digital sharecroppers" in this way, advocates resort to the traditional gaslighting about "banking the unbanked":

...

Trapped money is a big deal in markets such as the Philippines and Vietnam, low-wage countries where gamers have come to rely on Axie Infinity to pad their incomes. In the Philippines, by far the largest market for Axie Infinity, its popularity has been such that the authorities last year saw fit to remind gamers that profits from playing are subject to tax, local media reported.

proponents have argued that it ... helps with cheap and instant cross-border transfers in developing countries, or in the case of Axie Infinity, offers the promise of financial gains to those in poverty.The real victims are the indentured servants of the VCs:

With a large chunk of Axie Infinity players’ money locked in the virtual realm, that argument gets less convincing. Sky Mavis’s investors include billionaire Mark Cuban, Animoca Brands and Alexis Ohanian, the co-founder of Reddit.

“In terms of who gets harmed the most by this, it’s not the venture capitalists,” said Catherine Flick, associate professor in computing and social responsibility at De Montfort University in the U.K. “Even a few days’ delay in refilling the bridge, that’s going to affect someone feeding their family or paying bills, and in much, much greater a way than having a bit of a blip on someone’s investment portfolio.”

As Axie Infinity grew more popular, the up-front cost of playing by buying a squad of its mini monsters rose too high for some new users to afford. This led to the creation of “scholarship” programs, where Axie players can have their entry cost funded in exchange for providing these backers, known as guilds, with a chunk of their earnings. What this effectively created was a form of payday lending within the game — and as long as the Ronin bridge remains offline, scholars aren’t able to repay their debts.

“It’s basically indentured labor,” said Flick, noting that Axie Infinity’s developers are still able to reap the benefits of player activity even if the users can’t cash out their earnings. “These games create this kind of two-tier system, further dividing the haves and have-nots.”

And explainers of the underlying "bridge" technology from Olga Kharif in Understanding Crypto Bridges and $1 Billion in Thefts:

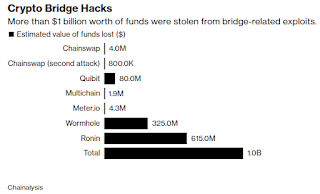

And explainers of the underlying "bridge" technology from Olga Kharif in Understanding Crypto Bridges and $1 Billion in Thefts:More than $21 billion is locked on Ethereum bridges, data from Dune Analytics show. On March 23, the Ronin Bridge, which is connected to the popular Axie Infinity online game was attacked, with the hacker stealing 173,600 Ether and 25.5 million USDC tokens in two transactions, for a total take of about $600 million. In February, hackers stole around $300 million from Wormhole, a bridge connecting Ethereum to the Solana blockchain. That same month, the Meter Passport bridge got hacked for several million dollars of crypto. In January, Qubit Finance, a project that enables cross-chain function was hacked. A total of seven bridge hacks have been recorded, according to data compiled by researcher Chainalysis.And a much more detailed one from Kyle Orland in How did a hacker steal over $600 million from a crypto gaming blockchain?:

Ronin's proof-of-authority system, centralized in just nine validator nodes, is the key to its ability to provide a higher volume of transactions at a much lower cost than the sprawling ethereum network. It also ended up being Ronin's weak point, in this case.And my favorite from David Gerard in Blockchain bridges: how the smart contract piñata works, and why bridges keep getting hacked:

As Sky Mavis explains, the unknown attacker was able to breach Sky Mavis' systems and gain full access to four validator nodes that the company controls. The attacker was then able to use a leftover backdoor in those nodes to gain control of another validator controlled by the decentralized Axie DAO.

With that fifth validator node, the attacker could then provide a majority of validation signatures on any transaction it wanted, leading to the fraudulent transfers.

A blockchain has a native currency, and may also run various other tokens. In decentralised finance (DeFi), a bridge lets you use a cryptocurrency from a different blockchain.Gerard provides this important corrective to the clickbait numbers that get thrown around:

The bridge holds the original crypto (e.g., Ethereum’s native currency, ether), and issues a token on the second chain that represents the original crypto (e.g., “wrapped” ether on Binance Smart Chain) — the token is like a banknote representing the reserve held on the original chain.

DeFi is correctly viewed as a piñata — you whack it in the right spot, and a pile of crypto falls out. This is because smart contract programming is brittle and demanding, but all the incentives are time-to-market — so you should expect sloppy work at every stage.

Bridges are the fattest piñatas in DeFi. When you see news of a crypto hack that says hundreds of millions of “dollars” were stolen, it was usually someone stealing the cryptos from a bridge.

Hack values stated in hundreds of millions of dollars can be misleading — these numbers are often the mark-to-market value of highly illiquid tokens when there’s nothing like that amount of buyers for them, so you could never realise the claimed dollar value even selling them legally. Wrapped cryptos are often blockable by the bridge’s administrators. Actual bitcoins or ether are relatively liquid, but a thief is unlikely to be able to realise hundreds of millions of dollars from selling stolen coins. So take some of the big numbers with a grain of salt.Note that in 8 years Lichtenstein and Morgan were only able to realize at most 21% of the Bitcoin they allegedly stole from Bitfinex, and it is unclear what that amounted to in real money. Hacker Moves Crypto Stolen From Ronin Breach to Help Cover Its Tracks by Muyao Shen shows that the Ronin malefactor has so far only moved about 1% of the loot:

A hacker moved some of the roughly $600 million in cryptocurrency stolen from the Axie Infinity play-to-earn gaming platform to a service that helps users mask transactions.Finally, from the "please God this was April 1st" department we have Rishi Sunak asks Royal Mint to create NFT.

About 2,000 Ether tokens, valued at around $7 million, that were lifted from Axie Infinity’s Ronin software bridge last month were moved Monday to Tornado Cash, blockchain data shows.

14 comments:

Michael McDonald's The Infuriating Reality of Traveling with Bitcoin in the World's Crypto Capital reports on a trip to El Salvador:

"By Friday the final tally looks grim for crypto fans. Only 10 of almost 50 businesses had taken Bitcoin, amounting to $485 out of $1,700 I’ve spent. And only four crypto transactions—at the pool hall, the peanut vendor, a Starbucks, and a Caterpillar-brand T-shirt store—had been entirely seamless. My experience isn’t a fluke. In a recent Chamber of Commerce survey of 337 businesses, only 14% said they’d transacted in Bitcoin since September.

I’d also paid $40 in Bitcoin fees, such as levies for transferring the currency between Coinbase and my digital wallet. My Visa, by contrast, is paying me—$20 in cash-back rewards.

At the airport, on the way home to San José, Costa Rica, I see the familiar blue glow of the Chivo ATM. Figuring I could use some cash, I tap the screen, get a text, and punch in the numbers: QR code, scan, wait. “Payment Sent,” my phone says. The $40 has left my digital wallet. A blue orbit symbol appears on the ATM screen, blinking as it processes. I wait. And wait some more.

The machine spits out a receipt with a transaction number. Hooray, it’s successfully taken my 0.00105 Bitcoin. But there’s a catch. The Chivo machine has accepted my crypto, for sure. But it dispenses no cash. Zero. None. The Chivo has eaten my Bitcoin. I never see my $40 again."

This won't end well. Crypto Industry Helps Write, and Pass, Its Own Agenda in State Capitols by Eric Lipton and David Yaffe-Bellany is a harbinger of disaster.

Timothy B. Lee's Wikipedia community votes to stop accepting cryptocurrency donations reinforces the idea that cryptocurrency donations are becoming radioactive:

"More than 200 long-time Wikipedia editors have requested that the Wikimedia Foundation stop accepting cryptocurrency donations. The foundation received crypto donations worth about $130,000 in the most recent fiscal year—less than 0.1 percent of the foundation's revenue, which topped $150 million last year.A"

Mattofak comments:

"I'm pretty sure no one in the technical team wanted to do the integration. But I recall having had two main reasons against it (1) I figured it would cost more to do the integration, maintenance, and reconciliation activities than the revenue it would bring in; and (2) cryptocurrency advocates were so extremely persistent in agitating for Wikimedia to support it that they burned any and all good will I might of had for them.

In the longer term, I suspect it came out revenue neutral or slightly positive. And although it made a small PR splash for bitcoin at the time it probably doesn't really affect anyone's perception of cryptocurrency legitimacy."

Mark Surman's Reporting Back on Mozilla’s Cryptocurrency Donation Policy shows Mozilla's response to their community:

"1. Mozilla will no longer accept 'proof-of-work' cryptocurrencies, which are more energy intensive.

2. Mozilla will accept 'proof-of-stake' cryptocurrencies, which are less energy intensive. Mozilla will develop and share a list of cryptocurrencies we accept by the end of Q2 2022."

In It’s okay to opt out of the crypto revolution, Rebecca Ackermann gets it right:

"But so far, the crypto industry has not made good on that democratizing promise. “Historically, claims like these often originate from groups of people with a significant amount of power and privilege already, who are seeking to reconsolidate and enhance that power in a new realm,” says Mar Hicks, a historian of technology, gender, and labor and the author of Programmed Inequality. Indeed, apart from a few lucky players, the crypto riches seem to be flowing mostly toward crypto executives and longtime Silicon Valley VCs, who need regular people to continue to invest in the industry so that it can keep growing."

Sarah Resnick's must-read Walk Away Like a Boss: Postcard from the cryptosphere is a truly excellent account of her experiences, with a valuable focus on the economic desperation that drives people to accept the extraordinary risks of this market:

"The more time I spent in the cryptosphere, the more I came to see it as a place where all our economic ills are refracted."

And:

"In theory, a decentralized internet was an appealing prospect. But there was a lot about Buterin’s vision that was difficult to love. How tragic, I thought, to reduce life to a procession of microtransactions or contracts. How naive to believe that some agreed-upon set of values could be formalized into code, or that the problems of politics could be made irrelevant by computation."

And:

"What I did not expect to find in this corner of the cryptosphere was an overwhelming number of seemingly ordinary people of all ages — some still teenagers, others parents to small children or caregivers to older family members — desperate to make money to get by. These were not the people I imagined seated behind a multiscreen trading setup or moving assets around an investment portfolio. Many were here, trying to make money in crypto, because they felt they had no other choice. People struggling financially; who despise their jobs; who feel the system is rigged and there is no way out. People whose country has been at war for years and want to leave, or who have left and want to help family members who stayed behind. From crypto they draw optimism for the future, the possibility that their lives could change or that they could change the lives of others"

Please go read the whole article.

In NFT sales drop 92% from peak, Molly White reports that:

"The Wall Street Journal reported that "the NFT market is collapsing", citing data from NonFungible that showed daily average sales of NFTs had dropped 92% from their September peak. They also reported that active wallets had dropped 88% from their November peak, suggesting fewer people were regularly trading NFTs.

As with all such articles, it must be taken with a grain of salt—it's very difficult to determine in the moment what's simply a temporary lull rather than a death spiral. Still, it may show growing disillusionment with a sector that's increasingly earned its reputation as full of scams and opportunities to lose money."

The Guardian is late to cryptocurrency weekend with David A. Banks' NFT scams, toxic ‘mines’ and lost life savings: the cryptocurrency dream is fading fast:

"The servers that mine crypto exist on the planet in real countries with laws, wars and resource shortages – which are governed by politicians that have real commitments and interests. With the Russian invasion of Ukraine, we are beginning to see an emerging geopolitics of crypto that looks very much like the old world of banking and finance."

Ben Thompson writes:

"Most of my discussion of Aggregation Theory has been about economics and concepts like zero marginal costs; just as it doesn’t cost anything to publish, it doesn’t cost Google anything (on a marginal basis) to help every person in the world find the specific piece of content they are looking for. This, by extension, motivates publishers to work well with Google, motivates users to use Google more, and gives Google the best possible opportunity to show ads, attracting more and more advertising.

In other words, centralization is a second order effect of decentralization: when all constraints on content are removed, more power than ever accrues to the entity that is the preferred choice for navigating that content; moreover, that power compounds on itself in a virtuous feedback loop."

From the "I'm shocked, shocked" department comes Crypto Might Have an Insider Trading Problem by Ben Foldy and Caitlin Ostroff:

"Anonymous wallets buy up tokens right before they are listed and sell shortly afterward

Public data suggests that several anonymous crypto investors profited from inside knowledge of when tokens would be listed on exchanges.

Over six days last August, one crypto wallet amassed a stake of $360,000 worth of Gnosis coins, a token tied to an effort to build blockchain-based prediction markets. On the seventh day, Binance—the world’s largest cryptocurrency exchange by volume—said in a blog post that it would list Gnosis, allowing it to be traded among its users."

Amy Castor and David Gerard report that Former OpenSea executive Nate Chastain arrested for insider trading of NFTs:

"A New York grand jury has charged former OpenSea executive Nathaniel Chastain, 31, with money laundering and wire fraud in connection with insider trading of NFTs.

...

Chastain’s name may be familiar — he’s OpenSea’s former head of product who was caught front-running OpenSea customers in September 2021. He bought NFTs just before they hit the front page of the site."

The mainstream media drumbeat continues with Steven Zeitchik's The crypto-skeptics’ voices are getting louder:

"Whatever the turning point, a growing group is sounding dire warnings about the dangers of cryptocurrency investment. Call them the crypto-catastrophists — bloggers and billionaires, mathematicians and economists, computer-scientists and 2008-crisis prophets and, even, a 2000’s-era Hollywood personality — who have all come together to unleash a warning to government and citizens about cryptocurrency investment. And their voices have, slowly, begun to rise above crypto’s evangelist din."

A Billion-Dollar Crypto Gaming Startup Promised Riches and Delivered Disaster by Joshua Brustein is an in-depth examination of the Axie Infinity disaster

"former Democratic presidential contender Andrew Yang called web3 “an extraordinary opportunity to improve the human condition” and “the biggest weapon against poverty that we have.”

By the time Yang made his proclamations the Axie economy was deep in crisis. It had lost about 40% of its daily users, and SLP, which had traded as high as 40¢, was at 1.8¢, while AXS, which had once been worth $165, was at $56. To make matters worse, on March 23 hackers robbed Sky Mavis of what at the time was roughly $620 million in cryptocurrencies. Then in May the bottom fell out of the entire crypto market. AXS dropped below $20, and SLP settled in at just over half a penny. Instead of illustrating web3’s utopian potential, Axie looked like validation for crypto skeptics who believe web3 is a vision that investors and early adopters sell people to get them to pour money into sketchy financial instruments while hackers prey on everyone involved."

And:

"[Axie co-founder] Zirlin said he empathized with people who’d lost money—life-changing sums, in some instances. But he added that a crash that got rid of Axie profiteers could have its upside, too. “Sometimes having to flush out the people who are just in it for the money,” he said, “that’s just the system self-correcting.”

And (my emphasis):

"At that point, anyone building NFT games was relying on the Ethereum blockchain to handle transactions, leaving character trading and other in-game actions subject to its inconsistent speed and notoriously high transaction fees. Sky Mavis built its own blockchain, Ronin, which lowered costs and improved speed by centralizing the key function of verifying transactions. Purists might have taken issue with the decision to abandon the core blockchain precept of decentralization, but on the other hand, the game actually worked."

A step forward! The Office of Government Ethics has issued guidance that, as Molly White reports:

"government employees who hold cryptocurrency may not work on policy or regulation that could potentially impact the value of their holdings."

But "government ethics" do not apply to the legislative or judicial branches. Sigh!

Post a Comment