Its time for an update on the disk media market., based on reporting from

The Register's Chris Mellor

here and

here and

here.

WD's hard disk shipments were basically flat in unit terms but

sharply up in exabytes:

Financial statements revealed 39.3 million disk drives were shipped,

slightly down on the 40.1 million a year ago. But that's 81.2 disk

exabytes shipped, much more than the year-ago total of 66.1. The average

selling price per drive stayed the same at $63.

A look at the disk segment splits shows the long-term

slump in disk drive sales as flash takes over in PCs, notebooks and the

high-performance enterprise drive areas.

Note the graph showing a kickup in "Consumer electronics". This may represent more large customers deciding that cheaper consumer drives are "good enough" for bulk storage. use.

Seagate hard disk shipments were flat in exabyte terms, meaning a

decline in unit terms:

In terms of exabytes shipped – mostly in disk drives – Seagate said

enterprise mission-critical exabyte shipments were flat year-on-year,

and there was 4.5 per cent growth on the previous quarter.

Nearline high capacity enterprise capacity shipped

declined 14 per cent, while PC exabyte shipments were up 14.3 per cent

year-over-year. Non-compute exabyte ships were down quarter-on-quarter.

The reason is that Seagate was

late delivering 10TB helium drives, a favorite in the bulk storage market:

Luczo has Seagate focused on bulk storage of enterprise data on

high-capacity disk drives, yet shipments of such drives fell in the

quarter as Seagate missed a switchover to 10TB helium-filled drives.

Stifel analyst and MD Aaron Rakers sees Western Digital having an 80 per

cent ship share in this market.

This failure, and even more Seagate's failure in the flash market, had a big impact on Segate's revenues and their

position against WD:

The right-hand side of the chart shows the $2.4bn gap in revenues that

is the result of Seagate boss Steve Luczo's failure to break into the

flash drive business and being late to helium-filled disk drives.

Seagate is now a shrinking business while WD is growing.

Seagate's response has been to

kick Luzco upstairs:

Steve Luczo will go upstairs to become executive chairman of the board

on October 1, with president and chief operating officer Dave Mosley

taking over the CEO spot and getting a board slot.

He's supposed to focus on the long term, but this doesn't seem to be his forte.

Mellor writes:

Seagate says Luczo will focus on longer-term shareholder value creation,

whatever that means. As he’s so far avoided Seagate getting any more

involved in the NAND business than if it were playing Trivial Pursuit,

we don’t have high hopes for moves in that direction.

Seagate's poor performance poses a real problem for the IT industry, similar to problems it has faced in other two-vendor areas, such as AMD's historically poor performance against Intel, and ATI's historically poor performance against Nvidia. The record shows that big customers, reluctant to end up with a single viable supplier of critical components, will support the weaker player by strategic purchases of less-competitive product.

The even bigger problem for the IT industry is that flash vendors

cannot manufacture enough exabytes to completely displace disk, especially in the

bulk storage segment:

NAND capacity shipped in the second quarter, including for phones and

other smart devices (some 40 per cent if capacity shipped), and

enterprise storage, was about 35 exabytes. The total HDD capacity

shipped number was 159.5 exabytes, almost five times larger, with some

58 exabytes constituting nearline/high-capacity enterprise disk drives.

So bulk storage could consume nearly twice the entire flash production, leaving none for the higher-value uses such as phones. Note that these numbers, combined with Aaron Rakers' revenue estimates:

|

Revenues in 2nd Quarter |

Annual Change |

Quarter Change |

| Flash |

c$13.2 Bn |

55% |

8% |

| Disk Drives |

c$5.7 Bn |

-5.5% |

-4% |

imply that Flash averages $0.38/GB where HDD averages $0.036/GB, or ten times cheaper per byte.

So the industry needs disk vendors to stay in business and continue to invest in increasing density, despite falling unit shipments. Because hard disk is a volume manufacturing business, falling unit shipments tend to put economies of scale into reverse, and reduce profit margins significantly.

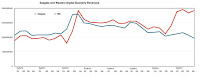

Kryder's Law implies that capacity shipped will increase faster than revenues. The graph shows capacity shipped increasing while revenues decrease. The IT industry must hope that this trend continues without killing the goose that is laying this golden egg.

No comments:

Post a Comment