Economic incentives are the glue holding the cryptosphere together. The security of Proof-of-Work blockchains depends upon the cost in hardware and power of an attack being more than the attack could gain. The security of Proof-of-Stake blockchains depends upon an attack reducing the value of the stake. There are economic incentives for market manipulation, pump-and-dump schemes, rug pulls, front-running and many other market behaviors. These are all very effective, but in this post I look at what appears to be a glaring exception to their effectiveness.

Economic incentives are the glue holding the cryptosphere together. The security of Proof-of-Work blockchains depends upon the cost in hardware and power of an attack being more than the attack could gain. The security of Proof-of-Stake blockchains depends upon an attack reducing the value of the stake. There are economic incentives for market manipulation, pump-and-dump schemes, rug pulls, front-running and many other market behaviors. These are all very effective, but in this post I look at what appears to be a glaring exception to their effectiveness.Permissionless systems are less efficient, slower, and vastly more expensive to set up and operate than permissioned systems performing exactly the same task. One would think that the permissioned systems would out-compete them, but in the cryptosphere they don't. Below the fold I attempt to answer the following obvious questions:

- Why are permissionless systems more expensive?

- How large is the investment in avoiding the need for permission?

- Where does the return on this investment come from?

- How large is the return on this investment?

the common meaning of ‘decentralized’ as applied to blockchain systems functions as a veil that covers over and prevents many from seeing the actions of key actors within the system.

Why are permissionless systems more expensive?

Fundamentally, they are expensive to operate because the only defense against Sybil attacks is to make mounting such an attack infeasibly expensive, and this requires that participation in the network be expensive. Permissioned systems can use cryptography to exclude attackers, so their security is exponential in the cost. The security of permissionless systems is linear in the cost, so at scale they are exponentially more expensive for the same level of security against attack.They are also more expensive to set up because they require massive replication of resources, which also makes them less efficient in operation. They are slower because they depend upon gossip protocols for communication and synchronization.

How large is the investment in avoiding the need for permission?

Let's estimate this for the two major cryptocurrencies, Bitcoin (BTC) and Ethereum (ETH).Bitcoin

|

| 2 pools control BTC |

As I write two pools control the Bitcoin blockchain, so a permissioned system of 7 Raspberry Pis using Byzantine Fault Tolerance (BFT) would provide the same attack resistance. It would be perhaps 1,000 times faster and at least 100,000 times cheaper.

Ethereum

|

| ETH transaction cost |

|

| 3 pools control ETH |

Where does the return on this investment come from?

As you can see, these systems are not actually decentralized, and cannot be. The costs are large and you don't get what you think you are paying for, so what is the economic incentive to pay them?Systems at least 1,000 times slower and 10,000 times more expensive than potential competitors that nevertheless succeed imply that they provide a return on their additional investment sufficiently greater than the potential competitor can. The permissioned system would accept the same inputs and generate the same outputs as the permissionless system, so the return cannot come from the performance of the system. The alternative explanation is that the permissioned system would be subject to regulation, preventing it from performing hugely profitable illegal transactions.

How large is the return on this investment?

That players in the cryptosphere place a very high value on the absence of regulation can be seen from Binance's extraordinary efforts to avoid it. These include establishing a US subsidiary that was simply a channel to the unregulated exchange, whose location was obfuscated but believed to be the Cayman Islands.If regulation is inevitable, the players place a very high value on ensuring that it is ineffective. This can be seen from FTX's at least $73M donations to candidates in the 2022 election cycle, and their lavish lobbying that led to CFTC chair Rostin Banham's comment that "Bitcoin might double in price if there’s a CFTC-regulated market.” and to the total capture of SEC Commissioner Hester Peirce.

Since the cost of permissioned competitors is many orders of magnitude less, an approximate lower bound on the return from absence of regulation is the cost of running Bitcoin and Ethereum, at least $24M/day or about $9B/year. In practice it must be much higher, since a return of $9B/year would leave the players no better off than if the system were permissioned.

A Counter-Argument

|

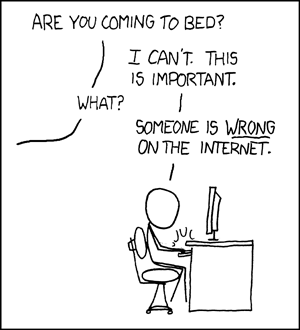

| xkcd (CC-By-NC) |

The economist replied that people would not use what he called a centralized system because the system owner could extract rent by holding the users to ransom. They were locked in since they had no alternative but to use the centralized system.

I couldn't figure out a response at the time, though it did seem strange that someone would argue for increasing the efficiency of the financial system using a much slower, much less efficient and much more expensive technology. Now I have had time to think about it I believe the economist's response was as bogus as their argument against regulation:

|

| Source |

- There are considerable switching costs between the multitude of current permissionless systems, for example the costs of bridging between different chains. Thus the operators of the various blockchains already extract excess rent from their locked-in users, as is shown by the enormous spikes in transaction costs when demand for transactions spikes.

- Just as there are many competing permissionless blockchain based systems, there could be many competing permissioned systems generating the same output from the same inputs as the permissionless ones. That a system is centralized because it is permissioned does not imply that there can be only one of them.

The degree of lock-in would be the same between permissionless and permissioned systems. Because the two systems would present the same interface to the user the switching costs would be the same. This cannot therefore be a justification for the excess investment. - The idea that a permissioned system would extract more rent than permissionless systems ignores the fact that both would run auctions for inclusion in blocks, maximizing their profit. The only difference would be that the permissioned system would process transactions at a much higher rate, making them cheaper.

- It isn't just that the underlying blockchains are covertly centralized, but that many of the essential systems layered on them are overtly centralized. Examples include API providers, exchanges, bridges and metastablecoins such as Tether. All can potentially extract rents.

- It seems implausible that the expectation of possible future rent extraction by permissioned systems would outweigh the fact that they were much cheaper and faster. Imposing a cost increase of several orders of magnitude would definitely overwhelm any possible switching costs, so it would be inefffective.

No comments:

Post a Comment