He shows how Amazon's strategy is not to generate and distribute profits, but to re-invest their cash flow into staring and developing businesses. Starting each business absorbs cash, but as they develop they turn around and start generating cash that can be used to start the next one.He is now back with a similarly insightful analysis entitled Amazon's profits, AWS and advertising, which starts:

People argue about Amazon a lot, and one of the most common and long-running arguments is about profits. The sales keep going up, and it takes a larger and larger share of US retail every year (7-8% in 2019), but it never seems to make any money. What’s going on?Below the fold, some details of Evans' explanation.

|

| AMZN profit |

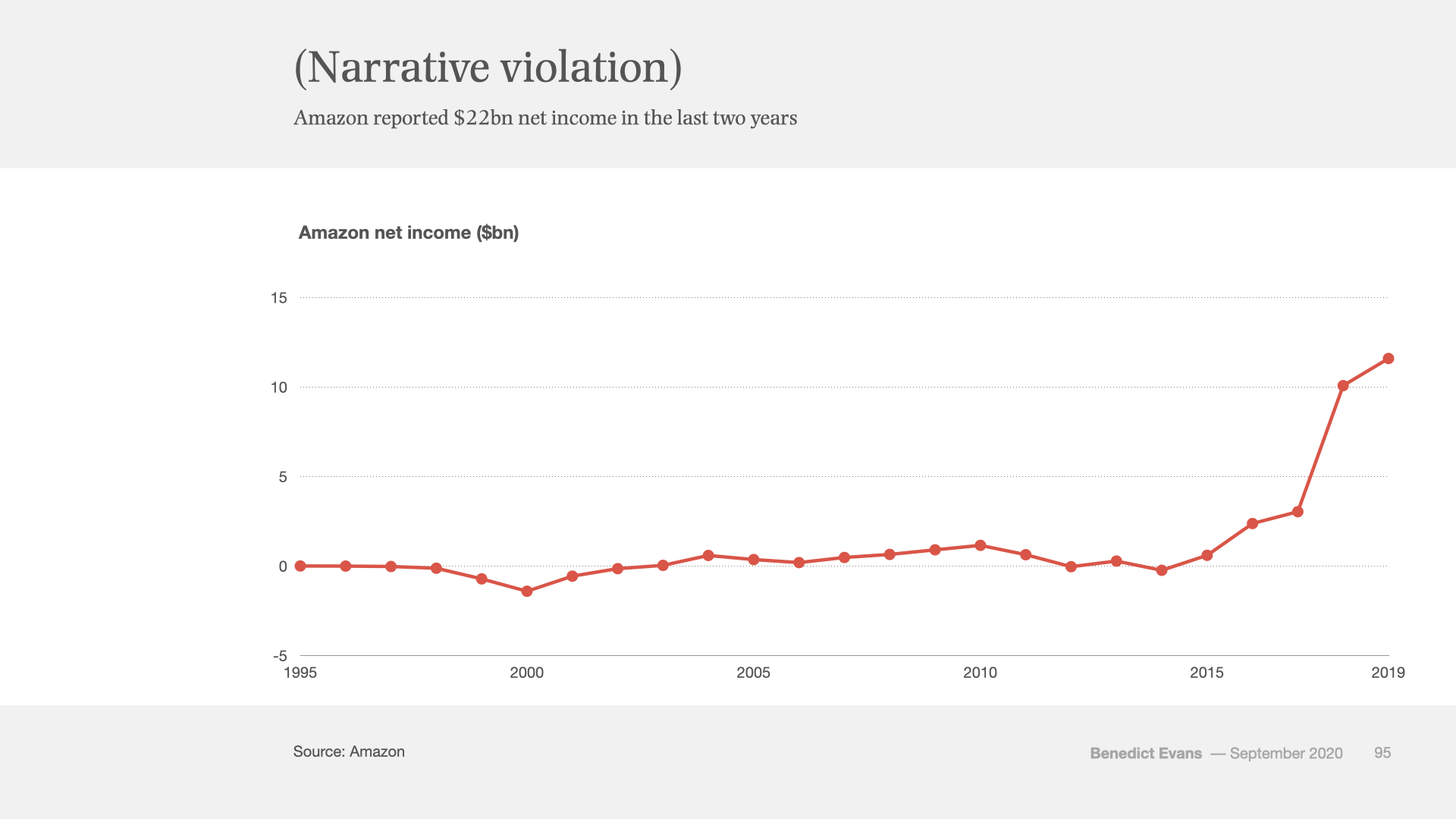

Evans' second graph shows that the "no profit" story stopped being true around 2015, with $22B reported for the last two years. Evans writes:

An obvious response here is that all of the profit is coming from AWS: it’s easy to assume that AWS’s profits subsidise losses in the rest of the company. By extension, if anti-trust intervention split AWS apart from the rest of the company, those cross-subsidies would go away and Amazon would have to put up prices, or grow more slowly, or at any rate be a less formidable and aggressive competitor.

|

| AMZN revenues |

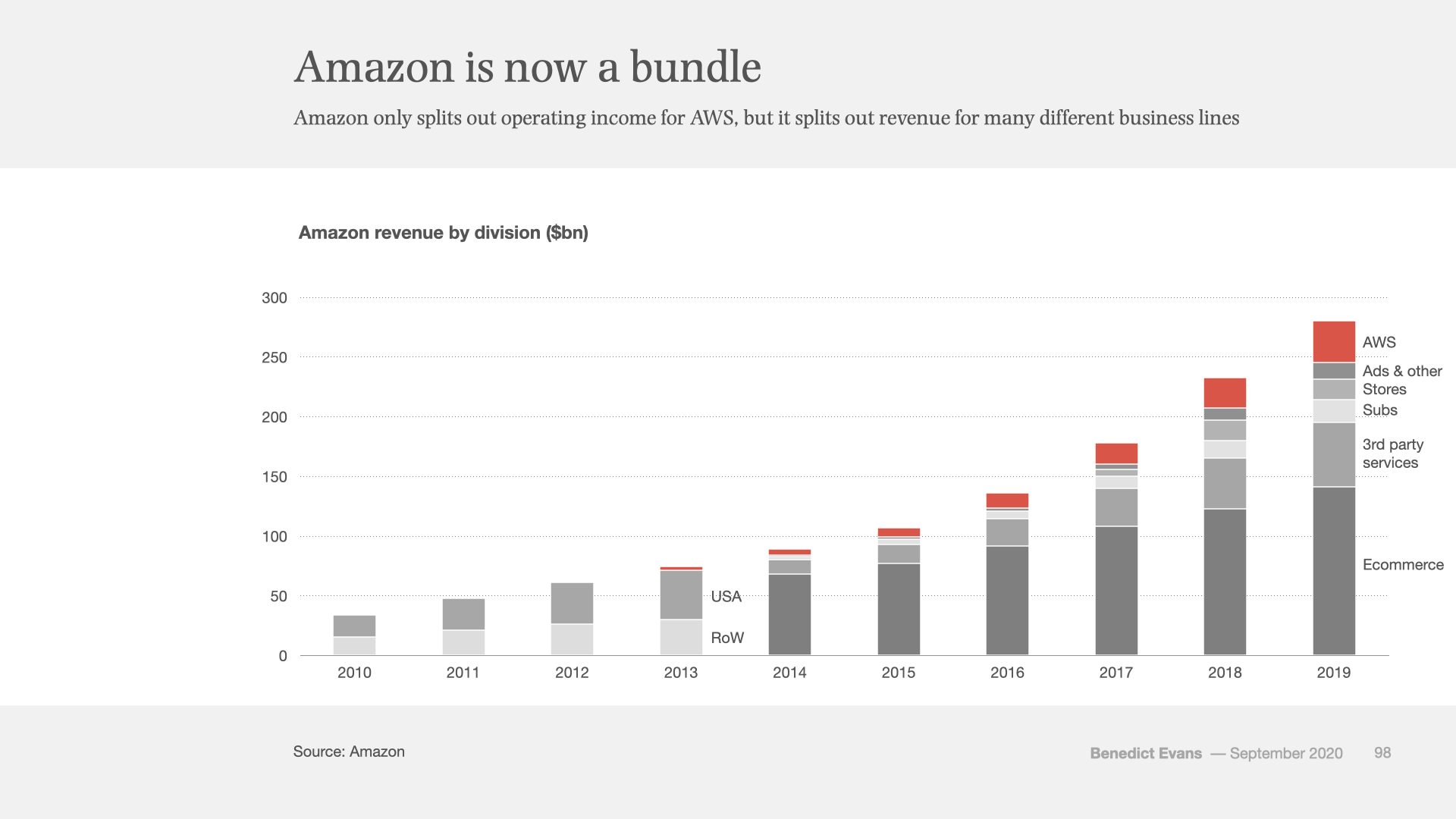

He proceeds to debunk this idea, showing that AWS and the US business report similar operating income, where the Rest of the World (RoW) business loses a significant amount. Using his six-year-old analysis, RoW is a startup business, where the US and AWS are mature. Note that RoW losses have decreased for the last three years. It is on track to become a mature business, subsidizing the next startup.

|

| Revenue sources |

Then he looks inside the US business, dividing it into:

- Ads and other

- Stores: Whole Foods etc.

- Subs: Prime subscriptions.

- 3rd party services: Marketplace

- ecommerce

As an intellectual exercise, it’s interesting to think about what this would look like if the accounting rules were different and everything sold and processed through Amazon’s website was reported as Amazon revenue. ... if these were reported on a like-for-like basis, Amazon’s revenue in 2019 would have been close to $450bn.Instead of $280B.

Amazon started getting serious about their advertising business around 2014, and five years later it generates revenue of almost $15B. Amazon doesn't disclose its margins, but Evans compares it to Google to estimate that in 2019 it generated about $8B in operating income, or nearly as much as AWS. Yet another successful Amazon internal startup! And a vindication of Evans' six-year-old model.

There are a lot of these internal startups. In What is Amazon? I wrote:

In Why It's Hard To Escape Amazon's Long Reach, Paris Martineau and Louise Matsakis have compiled an amazingly long list of businesses that exist inside Amazon's big tent. After it went up, they had to keep updating it as people pointed out businesses they'd missed.But I think Martineau and Matsakis have it wrong when they write:

While its retail business is the most visible to consumers, the cloud computing arm, Amazon Web Services, is the cash cow. AWS has significantly higher profit margins than other parts of the company. In the third quarter, Amazon generated $3.7 billion in operating income (before taxes). More than half of the total, $2.1 billon, came from AWS, on just 12 percent of Amazon’s total revenue. Amazon can use its cloud cash to subsidize the goods it ships to customers, helping to undercut retail competitors who don’t have similar adjunct revenue streams.Evans points out that, in effect, Amazon runs these startups as if they were independent companies that happened to share an owner:

Amazon’s own ecommerce product teams are charged an internal fee by the logistics platform and by the digital platform in much the same way that external marketplace vendors are charged a fee.The obvious big advantage these internal startups have over external ones is not Amazon cross-subsidizing product prices, although it has been argued that they have done that at times (Diapers.com or not), but that Amazon's cost of capital is vastly lower than an external startup's. Kristian Stout and Alec Stapp point out that:

Amazon has not raised equity financing since 2003. Nor is it debt financing: The company’s net debt position has been near-zero or negative for its entire history (excluding the Whole Foods acquisition)So the internal startups are financed from Amazon's free cash flow, not by Amazon issuing stock to satisfy investor's enthusiasm to buy into Amazon's monopoly. This is money that a more conventional monopoly would return to investors in the form of dividends. In effect, Amazon shareholders are investing in a VC fund, with the hope of future capital gains. Thus it is arguable that investors are funding Amazon's growth, not by subsidizing product prices, but by driving its development of new businesses.

No comments:

Post a Comment