|

| Source |

Follow me below the fold as I discuss the article and finally get to why the sting in the tail is interesting..

The article starts:

The BTM industry surged during the pandemic: The number of installed units increased more than five-fold over four years to about 31,100 units nationwide, according to Coin ATM Radar. But a closer look into the BTM boom revealed that the machines are often disproportionately located in areas with a majority of Black and Latino residents, charging fees as high as 22% per transaction.

|

| Wrosenb2 CC BY-SA 4.0 |

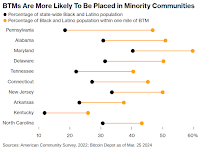

A Bloomberg review of Bitcoin Depot locations and data from the Census Bureau shows that states with proportionally large Black and Latino populations tend to have more of the company’s BTMs, especially in southern states like Georgia and Texas. Bitcoin Depot President and Chief Executive Officer Brandon Mintz dismissed any suggestion that the company targeted areas with underrepresented groups in deciding where to place its machines.But clearly there is something different about the populations of these areas:

“Never in our history have we once targeted an area based on any sort of racial profile,” Mintz told Bloomberg News. “Our focus is targeting areas that have low competition and that have populations that can support a Bitcoin ATM profitably.”

In Alabama, the concentration of Black and Latino residents within a mile radius of Bitcoin Depot BTMs is 20 percentage points higher than the broader state average, per a Bloomberg analysis of location data and the 2022 American Consumer Survey. In Dallas, BTMs are consistently located in areas where the highest percentages of Black and Latino people live.Among the mantras the crypto-bros never tire of repeating is that they are "banking the unbanked" and promoting "financial inclusion":

Proponents of cryptocurrency often tout the asset as a way to reach unbanked people, who lack a more traditional bank account. In the US, that comprised 6% of adults in 2022, per the Federal Reserve. Black and Hispanic people were more likely to be more unbanked than their White counterparts.The BTM operators are no exception:

Bitcoin Depot, the largest US operator with about 7,300 BTMs as of April 8, charges some of the highest fees in the industry while touting financial inclusion, a concept that ensures that all customers, regardless of their socioeconomic standing, have access to such financial services as savings, credit and insurance. Over 80% of Bitcoin Depot’s customers earn less than $80,000 a year, according to a November 2023 investor presentation from the company.I am a bit baffled as to how HODL-ing Bitcoin would provide "access to such financial services as savings, credit and insurance". I don't think Equifax and Trans-Union pay attention to your pseudonymous HODL-ings. And there is the matter of the fees the BTM operators charge for providing this access:

Mintz, the Bitcoin Depot CEO, said the percentage of a transaction the Atlanta-based company retains as its fees is typically in the “low twenties,” but would not provide a bottom or top boundary. “Nothing’s definitive, it just depends on the market and what we need to do to cover our expenses,” Mintz said. The company also charges a flat $3 fee on every transactionHow do the BTMs end up in locations near people lacking "financial inclusion"?

...

CoinFlip and Bitstop, Bitcoin Depot’s main rivals, charge transaction fees as high as 22%, depending on the location, according to company representatives and customer service agents. CoinFlip also charges a “network fee” of $2.49 on every transaction.

One restaurant owner in Essex, Maryland, who declined to give his name, said Bitcoin Depot paid $145 a month for the kiosk that was installed a month ago. Another store owner in New Jersey, who identified himself only as Jai, said his store received $200 a month for the kiosk, also operated by Bitcoin Depot.$145/month at 22% would be the fees on $660/month in transactions, and $200/month would be the fees on $909/month, which puts a floor on the business these BTMs do. It is likely much higher.

With all that as background, now for the sting in the tail:

The majority of BTMs — 92% of machines in the US, as indexed by Coin ATM Radar — don’t allow users to sell their crypto in exchange for cash.These machines are the Roach Motels of banking, your cash can check in but it can't check out. The question in my mind is:

What kind of customer needs to pay 22% plus $3 for "access to ... financial services" which won't let you cash out?Clearly, someone who cannot use conventional banks which, even if they do charge fees, will let you take money out. Two kinds of customers come immediately to mind:

- Criminals, who are willing to pay high fees to launder their ill-gotten cash into Bitcoin, which they will then convert into Tether at some exchange.

- Victims of crimes such as pig-butchering, where the perpetrators require payment in Bitcoin.

From the "what took them so long?" department comes Olga Kharif and Teresa Xie's Cryptocurrencies Dip After Report of US Probe of Tether:

ReplyDelete"Cryptocurrencies dipped across the board following a report that the US was investigating the issuer of the Tether stablecoin that underpins much of the trading in the digital asset world.

The US is investigating Tether Holdings Ltd. for possible violations of sanctions and anti-money-laundering rules, according to people familiar with the matter, the Wall Street Journal reported. Tether’s USDT token, which seeks to maintain a one-to-one peg with the dollar, dropped to around 99.81 cents.

...

Bitcoin, the largest cryptocurrency by market value, fell as much 3.3% to $65,878, after trading little changed for much of Friday. Solana slumped around 5.5%, while Dogecoin slipped about 5.6%."