Below the fold I explain why crypto will effectively end when there are no large, liquid exchanges, and look at the possibility that failures of major exchanges might happen.

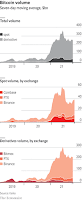

In my view there are two key dominoes still to fall, Coinbase as the largest and most credible regulated exchange, and Binance as the overwhelmingly dominant (and unregulated) exchange. Because Coinbase is regulated it is the most important exchange for retail traders, and because Binance is unregulated it is the most important exchange for professional traders and criminals.

One of the many ironies about "decentralized, trustless" cryptocurrencies is that they are neither decentralized nor trustless. There are three main reasons:

- Since in practice you can neither buy nor sell real goods using them, you need to trust an exchange to convert fiat to cryptocurrency and vice versa.

- The decision to cash out and buy the Lamborghini is driven by the "price" you expect to get for your HODL-ings. When does this "price" come from? It comes from recent trades on exchanges, typically of your favorite coin against USDT. Unless these exchanges have much greater volume than a Lamborghini per day, the "price" quoted will be meaningless. Getting an adequate volume requires attracting enough active traders to a single marketplace. Traders are used to centralized, fast, secure exchanges, so that is where they congregate.

- While it is true that transactions between holders of the same cryptocurrency can take place on a peer-to-peer basis using its native blockchain, the user experience is too difficult for ordinary mortals to perform safely, slow and subject to fee spikes. To transact between different cryptocurrencies without using a centralized exchange involves using a "DeFi" exchange; Defi, where code is law and law has vulnerabilities, which result in the money being stolen.

A rough estimate of the total amount of fiat currency that could be extracted from the black box can be made by taking the "attestations" of the major stablecoins at face value and summing them; there are unlikely to be large stores of fiat in the box that haven't been converted to stablecoins. This gets us $66.2B (USDT) + $44.2B (USDC) + $17.4B (BUSD) + $0.7B (USDD) = $128.5B, against a current total "market cap" of cryptocurrencies at around $800B. If there was a "bank run" in the cryptosphere, it is likely that the total recovery would be around the $128.5B or 16%. The costs involved in selling the non-cash securities forming part of the stablecoins' backing might be roughly matched by the fiat the estimate missed.

The connection between Binance and Coinbase is that the professionals at Binance depend in part on the retail

Coinbase

I wrote about Coinbase in The Exchange You Can Trust under the headings:- Trying To Sell Unregistered Securities

- Fiasco In India

- Misleading Customers About Their Funds And Keys

- "Losing Money Running A Casino"

- NFT Marketplace Fiasco

- Tolerating Insider Trading

- Actually Selling Unregistered Securities

- Forcing Arbitration On Customers

- Staking Customer's Coins

|

| Source |

Coinbase’s SEC 10-Q filing for the second quarter of 2022 puts on a brave face — but they’re in trouble. [Coinbase 10-Q; WSJ]The Q2 10Q was back in August, after Terra/Luna but before FTX/Alameda. The Q3 10Q wasn't any better:

Coinbase posted a $1.1 billion loss for Q2, down from $1.6 million in profit a year ago. This was Coinbase’s second consecutive quarter of losses — they lost $500 million in Q1.

Coinbase has $10 billion in cash, but $5 billion of that is customer deposits — and $4.6 billion flowed out in Q2. Coinbase needs real dollars flowing in.

The customer assets are flowing in the other direction. “Assets on platform” (mostly cryptos, some cash) totaled $256 billion in Q1 — but only $96 billion in Q2. $248 million in customer stablecoins was withdrawn from Coinbase just on July 15 — half the stablecoin holdings as of that day. [CryptoSlate]

9 million customers made even a single trade in Q2 2022 — down from a peak of 11.2 million in Q4 2021.

The retail crypto trade generated nearly 95% of trading fees on Coinbase in Q2.

In the third quarter of 2022, US exchange Coinbase suffered “another tough quarter.” Institutional trading was down 22% and retail volume was down 43%, compared to the previous quarter. Net revenue in Q3 was $576 million, down from $803 million in Q2, and $1.2 billion the year before. The company lost $545 million in Q3, compared to a net profit of $406 million in the same period last year.One cannot be confident that Coinbase will outlast the "crypto winter", and it isn't flowing fiat currency from retail into the ecosystem.

Binance

|

| Source |

Binance is a cryptocurrency exchange which is the largest exchange in the world in terms of daily trading volume of cryptocurrencies. It was founded in 2017 and is registered in the Cayman Islands.In 2019 Binance set up Binance.US. Tom Wilson and Angus Berwick write:

Binance was founded by Changpeng Zhao, a developer who had previously created high frequency trading software. Binance was initially based in China, but later moved its headquarters out of China shortly before the Chinese government imposed regulations on cryptocurrency trading.

In 2021, Binance was put under investigation by both the United States Department of Justice and Internal Revenue Service on allegations of money laundering and tax offenses. The UK's Financial Conduct Authority ordered Binance to stop all regulated activity in the United Kingdom in June 2021.

In 2021, Binance shared client data, including names and addresses, with the Russian government.

In February, a company called BAM Trading Services was incorporated in Delaware, using the same San Francisco address as Harry Zhou’s crypto trading company. BAM registered with the Treasury as a money-service business in June 2019, just as Binance said it was banning U.S.-based users from its main exchange.By October 2020 Michael del Castillo was writing Leaked ‘Tai Chi’ Document Reveals Binance’s Elaborate Scheme To Evade Bitcoin Regulators:

Days later, Binance unveiled a “partnership” with BAM Trading, saying BAM would license Binance’s name and trading technology to launch the Binance.US exchange. Zhao said Binance.US, led by BAM, would “serve the U.S. market in full regulatory compliance” and be a “fully independent entity.”

BAM was ultimately owned by Zhao, however, regulatory filings show. Its first chief executive, Catherine Coley, reported to the Binance.US board, chaired by Zhao. Binance’s Cayman Islands holding company kept custody of Binance.US customers’ digital wallets, according to a 2019 company financial report. And a company organogram showed Binance.US as part of the Binance group.

The 2018 document details plans for a yet-unnamed U.S. company dubbed the “Tai Chi entity,” in an allusion to the Chinese martial art whose approach is built around the principle of “yield and overcome,” or using an opponent’s own weight against him. While Binance appears to have gone out of its way to submit to U.S. regulations by establishing a compliant subsidiary, Binance.US, an ulterior motive is now apparent. Unlike its creator Binance, Binance.US, which is open to American investors, does not allow highly leveraged crypto-derivatives trading, which is regulated in the U.S.Last October in How Binance CEO and aides plotted to dodge regulators in U.S. and UK, Tom Wilson and Angus Berwick provided an even more detailed look at how Changpeng Zhao used Binance.US as a stalking horse to avoid regulation:

The leaked Tai Chi document, a slideshow believed to have been seen by senior Binance executives, is a strategic plan to execute a bait and switch. While the then-unnamed entity set up operations in the United States to distract regulators with feigned interest in compliance, measures would be put in place to move revenue in the form of licensing fees and more to the parent company, Binance. All the while, potential customers would be taught how to evade geographic restrictions while technological work-arounds were put in place.

new reporting by Reuters reveals fresh details about Binance’s strategy for keeping regulators at arm’s length and continuing disarray in its compliance programme. The reporting includes interviews with around 30 former employees, advisers and business partners and a review of thousands of company messages, emails and documents dated between 2017 and early 2022.Dirty Bubble Media looks into the relationship between Binance and Binance.US and asks Is Binance.US a Fake Exchange?:

It shows that in 2018, Zhao approved a plan by lieutenants to “insulate” Binance from scrutiny by U.S. authorities by setting up a new American exchange. The new exchange would draw regulators’ attention away from the main platform by serving as a “regulatory inquiry clearing house,” according to the proposal. Executives went on to set the plan in motion, company messages show.

In public, Zhao said the new U.S. exchange – called Binance.US – was a “fully independent entity.” In reality, Zhao controlled Binance.US, directing its management from abroad, according to regulatory filings from 2020, company messages and interviews with former team members. An adviser, in a message to Binance executives, described the U.S. exchange as a “de facto subsidiary.”

We can now report that based on blockchain transfers, market data, and company disclosures, it appears that there is no meaningful separation between the two firms. In fact, we show that Binance.US both transfers customer deposits to Binance and pays customer withdrawals using transfers back from the offshore exchange’s wallets. Further, we demonstrate that trades allegedly happening on Binance.US’s exchange are likely being conducted directly on the main Binance exchange.For example:

Yesterday, Binance US temporarily halted withdrawals of the Tether stablecoin (USDT). USDT, along with other stablecoins like USDC and Binance USD (BUSD), are dollar equivalent tokens on the blockchain backed by real dollar assets (in theory). It turned out that Binance US apparently didn’t have enough USDT in its wallets to pay back customers for several hours. The USDT balance in the main Binance US wallet dropped to its lowest level ever ($197,000) during this time period.Even early on it was obvious that Binance was playing fast and loose with regulation. In July 2019 David Gerard pointed out:

Twitter user @jconorgrogan was one of several people live-tracking the Binance.US withdrawal freeze. He noted that withdrawals restarted after Binance.US received a single transfer of $10 million USDT from an unidentified address. In turn, those funds had been pulled from two known Binance exchange wallets:

BNB is a token available on Binance. You can pay your trading fees with it — or you can trade it as if it was a crypto, like any other cryptocurrency or token listed on Binance.It seemed to take ages for US regulators to pay attention, and when they did it wasn't the SEC. In May 2021 Tom Schoenberg reported that Binance Faces Probe by U.S. Money-Laundering and Tax Sleuths:

BNB only imitates a crypto — it’s an entirely private token that’s traded in one venue. Binance control absolutely everything about it.

So, describing BNB as an “investment” in terms of its inner workings is like describing the inner workings of Amazon gift vouchers, or supermarket loyalty points — the answer to all such questions is: “it works however the company needs it to, at the time.”

BNB is useful if you trade a lot on Binance. But, Binance put BNB forth as being tradable — so it would almost certainly be a security in the US under the Howey test. There’s talk of BNB being listed on Binance US, their new regulated fiat (not Tether) exchange — it would definitely need to be traded like a security, for accredited investors only, and Binance had better file their Form D for exemption from registration.

The firm, like the industry it operates in, has succeeded largely outside the scope of government oversight. Binance is incorporated in the Cayman Islands and has an office in Singapore but says it lacks a single corporate headquarters. Chainalysis Inc., a blockchain forensics firm whose clients include U.S. federal agencies, concluded last year that among transactions that it examined, more funds tied to criminal activity flowed through Binance than any other crypto exchange.Because of its determined avoidance of regulation, Binance was always considered a hub for money laundering. In September 2021, China banned cryptocurrency transactions. Despite that, a year leter Pandaily reported that Chinese Authorities Crack Down on $5.6B Crypto-Related Money Laundering:

...

U.S. officials have expressed concerns that cryptocurrencies are being used to conceal illegal transactions, including theft and drug deals, and that Americans who’ve made windfalls betting on the market’s meteoric rise are evading taxes.

Police in Hengyang, a county in China’s southern province of Hunan alleged that the criminal group had been buying cryptocurrencies with illicit funds since 2018, which were then traded for US dollars at a profit. The dirty money reportedly originated from telecom scams or gambling.Despite all the public evidence that Binance is violating regulations to which it should be subject, Angus Berwick, Dan Levine and Tom Wilson report that U.S. Justice Dept is split over charging Binance as crypto world falters:

Police have arrested 93 related suspects across the country, frozen about 300 million yuan involved in the case, and recovered financial losses of 7.8 million yuan for the victim. The case is still undergoing further developments.

According to Chinese media outlet Blue Whale Finance, a large number of Binance accounts that were frozen in August are connected to the recent Hunan case.

Splits between U.S. Department of Justice prosecutors are delaying the conclusion of a long-running criminal investigation into the world's largest cryptocurrency exchange Binance, four people familiar with the matter have told Reuters.Note the 2018 start date, but note also the Binance's argument:

The investigation began in 2018 and is focused on Binance's compliance with U.S. anti-money laundering laws and sanctions, these people said. Some of the at least half dozen federal prosecutors involved in the case believe the evidence already gathered justifies moving aggressively against the exchange and filing criminal charges against individual executives including founder Changpeng Zhao, said two of the sources. Others have argued taking time to review more evidence, the sources said.

...

Reuters has investigated Binance's financial crime compliance over the course of 2022. The reporting showed that Binance kept weak anti-money laundering controls, processed over $10 billion in payments for criminals and companies seeking to evade U.S. sanctions, and plotted to evade regulators in the United States and elsewhere.

Binance's defense attorneys at U.S. law firm Gibson Dunn have held meetings in recent months with Justice Department officials, the four people said. Among Binance's arguments: A criminal prosecution would wreak havoc on a crypto market already in a prolonged downturn. The discussions included potential plea deals, according to three of the sources.When did it become the US Dept. of Justice's job to protect the cryptocurrency industry?

Some of the difficulties prosecutors face are the state of Binance's records:

Zhao became concerned about U.S. authorities gaining access to Binance's internal records, company messages show.Tom Wilson, Angus Berwick and Elizabeth Howcroft reported that Binance's books are a black box, filings show, as it tries to rally confidence:

A guide issued to employees for one encrypted messaging service listed its "automatic self-erasing messages" as a benefit. ...

Binance was struggling to respond to the DOJ because many of the records relevant to the Department's request had already been erased due to Zhao's secrecy rules. This extended, ... to Zhao's approvals for financial decisions at Binance.US, the separate American exchange which publicly says it is "fully independent" of the main Binance platform.

After the collapse of rival exchange FTX last month, Binance's founder Changpeng Zhao promised his company would "lead by example" in embracing transparency.They tried whatever they could:

Yet a Reuters analysis of Binance's corporate filings shows that the core of the business – the giant Binance.com exchange that has processed trades worth over $22 trillion this year – remains mostly hidden from public view.

Binance declines to say where Binance.com is based. It doesn't disclose basic financial information such as revenue, profit and cash reserves. The company has its own crypto coin, but doesn't reveal what role it plays on its balance sheet. It lends customers money against their crypto assets and lets them trade on margin, with borrowed funds. But it doesn't detail how big those bets are, how exposed Binance is to that risk, or the full extent of its reserves to finance withdrawals.

In an effort to look inside Binance's books, Reuters reviewed filings by Binance units in 14 jurisdictions where the exchange on its website says it has "regulatory licenses, registrations, authorisations and approvals." These locations include several European Union states, Dubai and Canada. Zhao has described the authorisations as milestones in Binance's "journey to being fully licensed and regulated around the world."This reinforces Dirty Bubble Media's conclusion.

The filings show that these units appear to have submitted scant information about Binance's business to authorities. The public filings do not show, for example, how much money flows between the units and the main Binance.com exchange. The Reuters analysis also found that several of the units appear to have little activity.

Former regulators and ex-Binance executives say these local businesses serve as window dressing for the main unregulated exchange.

As far as the holding company is concerned, they had to take this on trust:

As part of a "commitment to transparency," Binance last month published on its website a "snapshot" of its holdings of six major tokens and promised to share a complete set of data at an unspecified future date.Another part of Binance's obscurity relates to BUSD, their stablecoin. Amy Castor and David Gerard noted:

Data firm Nansen said the holdings, worth around $70 billion at the time of the Nov. 10 snapshot, had fallen to $54.7 billion by Dec. 17 after withdrawals and price fluctuations. Two "stablecoins" that are pegged to the dollar – Binance's BUSD and market leader Tether – accounted for almost half of its holdings. Around 9% of the assets were in BNB, its in-house token which Binance itself has issued, the Nansen data showed.

BUSD is a Paxos-administered dollar stablecoin. Each BUSD is backed by an alleged actual dollar in Silvergate Bank, and attested by auditors. (If not actually audited as such).They based this on Binance's own Web site:

That’s true of BUSD on the Ethereum blockchain. It’s not true of BUSD on Binance.

BUSD on Binance is on their internal BNB (formerly BSC) blockchain, bridged from Ethereum. It’s a stablecoin of a stablecoin. Binance makes a point of noting that Binance-BUSD is not subject to the legal controls that Paxos BUSD is under.

New York state regulators have enforced particular measures on Paxos, Binance, and how the stablecoin must operate. Along with making sure the token is fully collateralized, Paxos must carefully control the creation and burning of BUSD tokens. Paxos also has the right to freeze accounts and remove funds if needed due to illegal activity. These principles all adhere to the Trust Charter and New York banking laws applicable to the stablecoin.Nidhi Pandurangi's Read the full memo the CEO of Binance sent to staffers after the exchange was hit by more than $1 billion of withdrawals in a day amid the FTX fiasco reported outflows from Binance:

Inbuilt within the smart contracts of the token is a new function that reflects the regulation of the stablecoin: SetLawEnforcementRole. This small piece of code allows Paxos to use the powers mentioned previously in upholding NYDFS regulations.

As noted above, these features apply to the Paxos-issued BUSD on Ethereum. Binance-Peg BUSD, issued by Binance on BNB Chain (formerly Binance Chain and BNB Smart Chain), operates pursuant to different procedures and is not issued by Paxos or regulated by the NYDFS.

On Tuesday, jittery investors withdrew more than $1 billion from Binance, the world's largest crypto exchange. Hours later, the company's CEO, Changpeng "CZ" Zhao, sent a memo to staffers where he seemed to try to assuage market fears in the aftermath of the implosion of crypto peer FTX.The article quoted CZ thus:

...

Phil Rosen reported on Wednesday that Binance has seen about $3.66 billion in net outflows in the seven days preceding December 13

With regard to questions on the temporary halt of withdrawals of USDC, because we auto convert USDC to BUSD in order to retain large liquidity pools, we generally retain USDC deposits for future withdrawals. In today's case, many people deposited BUSD or USDT to withdraw USDC. When this happens, we need to convert. Our current conversion channels are clunky. We have to go through a bank in NY in USD, which is slow.Presumably, when Binance converts USDC to BUSD, the result is BUSD-on-BNB. More was revealed in this thread by DataFinnovation (unroll) in response to this tweet from @cryptohippo65:

I'm calling on onchain analysis twitter sleuths to look at this, to see if they can shed light on how a wallet can contain 22M BNB without a record of a deposit.Datafinnovation's thread is too detailed to excerpt, but as I understand it the gist is that the implementation of BNB Chain is complex, opaque and does not conform to the definition of a blockchain. Transactions are not fully visible and auditable. Datafinnovation believes that, because BUSD-on-BNB are created and destroyed via a bridge from BUSD-on-Ethereum, the total amount of "dollars" in the system matches the number reported by Paxos. But what is happening to them on BNB Chain is opaque. The result is a system credibly backed one-for-one by USD but where transactions cannot be effectively traced. This could greatly assist Binance in laundering money.

In summary, what we have in Binance is:

- Fanatical efforts to avoid regulation, including establishing "fake exchanges" that deflect regulators while serving only as channels to and from the unregulated exchange.

- An established history of laundering billions of dollars.

- An exchange banned from operating in many jurisdictions.

- Completely opaque finances, including reserves and profit/loss.

- Substantial outflows after the collapse of FTX.

- A "blockchain" which is un-auditable and whose implementation is opaque.

- A long-standing criminal investigation by the US Dept. of Justice.

- An exchange run on "self-erasing messages".

Avraham Eisenberg believes that "code is law" in DeFi. He admits to using an exploit to transfer cryptocurrency "worth" about $116M from Mango Markets to himself. Molly White quotes him thus:

ReplyDeletehe "was involved with a team that operated a highly profitable trading strategy last week. I believe all of our actions were legal open market actions, using the protocol as designed, even if the development team did not fully anticipate all the consequences of setting parameters the way they are."

Law enforcement doesn't think "code is law" but rather "law is law". Molly White reports that the Feds:

"arrested Eisenberg in Puerto Rico on December 26. He is charged with commodities fraud and commodities manipulation."

Concoda's Is Binance the Next Domino to Fall? covers many of the same points I did above. It includes some additional red flags, such as:

ReplyDelete"Binance might not even have a functioning balance sheet, a scenario that has grown increasingly plausible after a Reuters analysis revealed the company’s filings were a “black box.” By far the most ominous detail was that Binance’s former chief financial officer, Wei Zhou, never obtained access to the company’s full accounts during his three-year tenure."

And:

"Constance Wang, the head of risk management at FTX, had previously left the investment banking world, because she felt her previous role at Credit Suisse (an institution with an already infamous record of poor risk management) was “boring”. Meanwhile, it turned out that FTX’s chief regulatory officer, Daniel Friedberg, was the lawyer caught on tape trying to cover up a cheating scandal at the poker site, Ultimate Bet."

Another Angus Berwick and Tom Wilson story I should have included is How crypto giant Binance became a hub for hackers, fraudsters and drug traffickers. It starts:

ReplyDelete"In September 2020, a North Korean hacking group known as Lazarus broke into a small Slovakian crypto exchange and stole virtual currency worth some $5.4 million. It was one of a string of cyber heists by Lazarus that Washington said were aimed at funding North Korea's nuclear weapons programme.

Several hours later, the hackers opened at least two dozen anonymous accounts on Binance, the world's largest cryptocurrency exchange, enabling them to convert the stolen funds and obscure the money trail, correspondence between Slovakia's national police and Binance reveals."

And:

"Binance processed transactions totalling at least $2.35 billion stemming from hacks, investment frauds and illegal drug sales, Reuters calculated from an examination of court records, statements by law enforcement and blockchain data, compiled for the news agency by two blockchain analysis firms. Two industry experts reviewed the calculation and agreed with the estimate."

The story keeps throwing out details like these. Go read it.

Luke Dashjr is a Bitcoin Core developer so presumably another believer that "code is law". Just as Senator Moynihan quipped "A conservative is a liberal who’s been mugged” it appears that a centralizer is a decentralizer who's been "hacked". Dan Goodin reports that Key bitcoin developer calls on FBI to recover $3.6M in digital coin:

ReplyDelete"There’s still a lot that doesn’t add up to the events Dashjr has reported. Without more details, it’s hard to come to any firm conclusions. One takeaway, however, is clear, as evidenced by one of the most influential bitcoin developers calling on law enforcement to recover his stolen digital coin: The notion that cryptocurrencies provide a decentralized platform that cuts out established authorities is nothing short of a pipe dream."

Matthew Goldstein and Emily Flitter report that Coinbase Reaches $100 Million Settlement With New York Regulators:

ReplyDelete"Coinbase, a publicly traded cryptocurrency trading exchange based in the United States, agreed to pay a $50 million fine after financial regulators found that it let customers open accounts without conducting sufficient background checks, in violation of anti-money-laundering laws.

The settlement with the New York State Department of Financial Services, announced Wednesday, will also require Coinbase to invest $50 million to bolster its compliance program, which is supposed to prevent drug traffickers, sellers of child pornography and other potential lawbreakers from opening accounts with the exchange."

Cryptocurrency contagion continues in Steve Dickson's Silvergate Tumbles After FTX Implosion Prompts $8.1 Billion Bank Run:

ReplyDelete"Silvergate Capital Corp. slumped in early trading after the bank said the crypto industry’s meltdown triggered a run on deposits, prompting the company to sell assets at a steep loss and fire 40% of its staff.

Customers withdrew about $8.1 billion of digital-asset deposits from the La Jolla, California-based bank during the fourth quarter, which forced it to sell securities and related derivatives at a loss of $718 million, according to a statement Thursday. Executives said on a conference call that Silvergate may become a takeover target."

Molly White points out that the $718M loss:

ReplyDelete"far exceeds the bank's total profits since at least 2013, writes the Wall Street Journal."

Also:

"Silvergate announced that they would be cutting 40% of their staff — around 200 employees. They also announced that they would be taking a $196 million impairment charge on assets they purchased from Diem — Facebook's blockchain-based payment system once known as Libra."

So Silvergate is at least $916M in the hole.

Matt Turner adds to Silvergate's misery in Cathie Wood Sells 99% of Silvergate Stake as Customers Flee:

ReplyDelete"One of Cathie Wood’s funds sold virtually all of its shares in Silvergate Capital Corp. after the cryptocurrency-focused bank announced that it was forced to sell assets at a steep loss as customers pulled out most of their deposits during the fourth quarter.

Her ARK Fintech Innovation exchange-traded fund unloaded roughly 404,000 shares of Silvergate on Thursday, cutting the ETF’s holdings by more than 99%, according to data compiled by Bloomberg. The fund’s remaining holdings, which amount to less than 4,000 shares, are worth about $43,000 — only about 0.01% of the fund’s total portfolio."

But wait, there's more! Yueqi Yang and Hannah Levitt report that Crypto Panic at Silvergate Spawns a New Breed of Bank Run:

ReplyDelete"Silvergate Capital Corp., a California lender that offers digital-asset ventures a place to park their cash, jolted shareholders Thursday with the revelation that it had recently survived an $8.1 billion drawdown on deposits. That’s roughly 70%, even more severe than runs seen in the Depression.

...

Silvergate’s disclosure — which included selling assets at a loss to raise cash — sent its stock tumbling, bringing its total slide to more than 90% since the end of 2021, the year Bitcoin reached a record high.

The shares slid again on Friday, dropping as much as 14%, as analysts warned that the deposit run might not be over. The balances could be headed back toward 2020 levels, prior to the bull run in crypto prices,

...

The concern was reflected in the deeply distressed price of Silvergate’s preferred securities, which trade at about 40 cents on the dollar. Bloomberg Intelligence warned that the 5.375% interest payment may be in jeopardy.

...

Silvergate had to sell nearly half of its securities portfolio, liquidating $5.2 billion of debt securities for cash. In that rush, it incurred $718 million in losses. The firm said it anticipates more hits as it sells securities to reduce its $6.7 billion in wholesale borrowings."

This is what the Federal Reserve, FDIC, and the Office of the Comptroller of the Currency were warning against in their Joint Statement on Crypto-Asset Risks to Banking Organizations:

"• Significant volatility in crypto-asset markets, the effects of which include potential impacts on deposit flows associated with crypto-asset companies.

• Susceptibility of stablecoins to run risk, creating potential deposit outflows for banking organizations that hold stablecoin reserves"

Sidhartha Shukla and Olga Kharif report that Justin Sun Moves $100 Million of Crypto to Support His Exchange Huobi:

ReplyDelete"An Ethereum wallet associated with Sun withdrew $50 million of Tether’s USDT and $50 million of Circle Financial’s USDC from the Binance exchange on Friday, and roughly three hours later sent the tokens to Huobi, according to blockchain research firm Nansen.

...

“It just shows the confidence to Huobi exchange,” Sun said of the transfers in a Telegram message. “It’s just my personal funds.”

The transactions came amid elevated pressure on Singapore-based Huobi, which saw about $85 million of crypto outflows over a 24-hour period according to data from Coinglass. The exchange said on Friday that it plans to fire about 20% of its workforce and will maintain a “very lean team” as a slump in crypto markets enters its second year."

Allyson Versprille and Ava Benny-Morrison report that Crypto Empire DCG Faces US Investigation Over Internal Transfers:

ReplyDelete"Federal prosecutors in Brooklyn are scrutinizing transfers between Digital Currency Group Inc. and an embattled subsidiary that offers crypto lending services, said the people, who asked not to be named because the probe hasn’t been made public. They’re also delving into what investors were told about those transactions.

...

In a November letter to shareholders, Silbert disclosed that DCG received about $575 million in loans from Genesis Global Capital that are due this May. He also mentioned a $1.1 billion promissory note due in June 2032, resulting from DCG assuming liabilities Genesis had from exposure to Three Arrows."

These loans featured in Cameron Winklevoss' letter to Barry Silbert.

Molly White reports that Genesis lays off another 30% of staff:

"After a round of layoffs in August that impacted 20% of their employees, Genesis is laying off another 30% of their employees."

I'm sure everything at Huobi is just fine. Molly White reports that Huobi performs 20% layoff, reportedly requires employees to take salary in stablecoins:

ReplyDelete"The major cryptocurrency exchange Huobi confirmed they planned to lay off 20% of employees, shortly after Huobi's advisor and somewhat its public face, Justin Sun, denied any layoffs were planned.

Crypto reporter Colin Wu has also reported that the company is requiring all employees to begin accepting their salaries in Tether or USDC stablecoins, or face dismissal. Rumors on Twitter emerged that internal communications channels had been shut down to quell dissent over the change."

It's all just FUD.

Amy Castor and David Gerard are out with the latest on the various dominoes in Crypto collapse: DCG’s problem is Grayscale, FTX Bahamas agreement, DeFi trading arrest, Silvergate Bank, Huobi, Binance.

ReplyDeletePhilip Lagerkranser and Yueqi Yang report that Coinbase Eliminates 20% of Staff in Latest Round of Layoffs:

ReplyDelete"Coinbase Global Inc. is firing about 950 employees, or 20% of its workforce, as the worsening crypto slump spurs another round of layoffs at the biggest US digital-asset exchange.

Co-founder and Chief Executive Officer Brian Armstrong announced the job reductions in a blog post Tuesday, saying the steps were needed to weather the industry downturn. In June, Coinbase announced it would lay off 18% of its workforce, the equivalent of roughly 1,200 employees. It eliminated another 60 positions in November. It will now shut down several projects."

Izabella Kaminska's interview with David Gerard was "sponsored by Big Nocoin, the Federal Reserve and the Pentagon" and is well worth a read.

ReplyDeleteRachel Butt and Olga Kharif report that Crypto Firm Genesis Is Preparing to File for Bankruptcy:

ReplyDelete"Genesis Global Capital is laying the groundwork for a bankruptcy filing as soon as this week, according to people with knowledge of the situation.

The cryptocurrency lending unit of Digital Currency Group has been in confidential negotiations with various creditor groups amid a liquidity crunch. It has warned that it may need to file for bankruptcy if it fails to raise cash, Bloomberg previously reported."

David Yaffe-Bellany reports that Genesis, a Crypto Lending Firm, Files for Bankruptcy:

ReplyDelete"A year ago, Genesis and a group of other large lending firms drew millions of customers with the promise that they could deposit their crypto holdings and earn sky-high returns. But Genesis’s bankruptcy filing makes it the fourth major crypto lender to fail since last spring, when a downturn in the digital asset market sent prices plunging. Other major lenders that have gone out of business include Celsius Network and Voyager Digital, whose customers lost billions of dollars in deposits."

The payment processors servicing Binance, Huboi, Nexo and other exchanges are "totally legit", as Dirty BNubble Media reports in The Russian-Linked Payment Processors Feeding the Crypto-conomy:

ReplyDelete"Advcash’s clients include the crypto exchanges Binance, Huobi, OKCoin, and the Nexo crypto lending firm. It turns out this company, while legally domiciled in Belize, actually appears to be operated out of Eastern Europe and Russia. Its founder and CEO is tied to at least one failed cryptocurrency scheme. And it turns out that another major crypto payments firm shares links to both Advcash and to the same crypto scam…"

Cagan Koc reports that Coinbase Gets Dutch Fine for Operating Without Registration:

ReplyDelete"The Dutch Central Bank fined crypto exchange Coinbase for providing digital-asset services in the country prior to its local registration in September.

The central bank said Thursday it’s imposing an administrative fine of €3.33 million ($3.63 million) on Coinbase Europe Ltd. for operating in the country without registering with the monetary authority. Coinbase obtained its registration in the Netherlands on Sept. 22."

Olga Kharif reports that Coinbase’s Quarterly Crypto Trading Volume Likely Lowest Since Before Public Debut:

ReplyDelete"The largest US digital-asset platform registered about $76 billion in spot trading volume, a drop of 52% from the year-ago period, according to data compiled by researcher CCData. The tally is also likely the least since before the company’s much ballyhooed direct listing on the Nasdaq Stock Market in April 2021, or just months before prices of cryptocurrencies peaked.

...

Coinbase is forecast to post a seventh consecutive quarterly loss when it releases results on Nov. 2, according to analysts surveyed by Bloomberg."

Olga Kharif and Anna Irrera note the air of desperation in Crypto Exchanges in ‘Existential Struggle’ Embrace Lending:

ReplyDelete"Crypto lending is still small compared with the leverage bubble that took down large swathes of the sector when it burst in 2022, and executives say they’ve taken pains to avoid a repeat. Yet the comeback risks creating new opaque pockets of leverage across crypto markets that could exacerbate the impact of any major correction in prices.

A more urgent concern for exchanges may be that the initiatives are showing few signs of rekindling moribund trading."