Louis Ashworth's

The unbearable stability of bitcoin points to a mystery:

Bitcoin’s doing fine, thanks for asking.

Amid a shaky few months for markets, the world’s favourite cryptocurrency has been remarkably stable, trading in the narrowest range since late 2020

...

As might be expected, that lack of movement has coincided with a downturn in activity on most exchanges other than market leader Binance, which has cut fees to drum up more business and now hosts about a fifth of all volume

...

Stability looks good, at least relative to what’s happening elsewhere. But thinning volumes in a market that has no utility beyond store of value, where the actions of its few active daily participants are being determined by technical resistance and support levels, is not a symptom of robust health.

Below the fold I look into this persistent failure to proceed moon-wards

Vildana Hajric's headline tells the recent story —

Bitcoin Breakout Stalls With Daily Trading Volume Also Tumbling:

Cryptocurrency price increases have mostly stalled following two days of gains that had spurred optimism for a more sustainable rally.

Bitcoin, the largest token by market value, declined as much as 1.5% on Thursday to once again trade around $20,000, a level it’s been stuck around for weeks. Ether was little changed, while an index tracking the 100 largest coins also fell.

Hajric continues:

Interest in crypto has waned amid a slump in prices that’s seen Bitcoin lose 70% from its all-time high of near $69,000 in November. Retail investors, in particular, have been disenchanted by the asset class. They’ve not been wading into the market in the same way they did during the first two pandemic years, with Google searches for the word “crypto” falling to the lowest levels in the past year.

Why would retail investors buy? They are facing high inflation and a looming recession, their stock and bond portfolios are evaporating, and their cryptocurrency HODL-ings have evaporated even faster.

It isn't just retail:

Meanwhile, institutional digital-asset products this month saw their lowest-ever volume in data going back to June 2020, with average daily trading volume dropping 34% to $61 million, according to CryptoCompare.

Most investors want to decrease their cryptocurrency leverage, fearing margin calls. Yueqi Yang reports that

Crypto Broker Genesis Says Lending Plunged 80% in Third Quarter:

Crypto brokerage Genesis, reeling from a sharp decline in the digital-asset market that sent the industry into a tailspin, said it originated $8.4 billion in new loans in the third quarter, an 80% plunge from the prior three-month period. Most of the rest of its businesses also experienced substantial declines.

Total active loans slumped to $2.8 billion from $4.9 billion in the second quarter, Genesis said in its quarterly earnings report. Trading volumes also declined, with spot volume sliding 44% to $9.6 billion. Its derivatives desk traded $18.7 billion in notional value, down 30% from the prior quarter.

...

Genesis was the biggest creditor ensnared in the collapse of Three Arrows after the once highflying hedge fund failed to meet margin calls. Over the summer, the company cut staff by 20% and overhauled its leadership team. A series of senior executives have departed, including its co-head of sales and trading Matt Ballensweig and head of derivatives Joshua Lim. Most recently, its new chief risk officer Michael Patchen also left after three months.

Because there are no retail buyers, and because the institutional HODL-ers don't want to realize their losses,

everyone is just HODL-ing:

The proportion of Bitcoin that has been held for one year and over is at an all-time high, with more than a quarter of total supply now not having moved on-chain for at least five years, according to Genesis.

The amount of Bitcoin that hasn’t moved in over a year reaching a record of over 66% this week means that there’s “less and less BTC readily available to new entrants,” said Noelle Acheson, author of the “Crypto is Macro Now” newsletter.

But there are plenty of other signs investors remain uninvolved. The 14-day moving average of perpetuals volumes, as measured via FTX, reached its lowest point since the start of 2021, according to data compiled by Strahinja Savic at FRNT Financial. And the drop in derivatives volumes has come alongside a slump in spot volumes. Savic points out that the 14-day moving average volume of BTC/USD on the crypto platform is also at its lowest since April of last year.

Amy Castor and David Gerard

explain it differently:

Crypto has crashed, and some of our readers are asking us why the price of bitcoin has been holding steady at around $19,000 to $20,000 for the past few months. Why won’t it go down further?

We think the price of bitcoin is a high wire act. If the price drops too low, some leveraged large holders could go bust. So the number needs to be kept pumped above that level. If the price goes up too far, the suckers — not just retail, but the bitcoin miners — may be tempted to cash out at last.

The idea is to pump just enough to keep the price up — but not so much that suckers dump their bitcoins directly into the pump.

If too many bagholders try to sell, what quickly becomes obvious is there are no actual buyers. At least, none with real money.

The party is over. Retail investors have all gone home, so there are no more suckers getting in line to pump the price up anymore. Coinbase’s 10-Q showed a drop in retail dollars.

In addition to a dearth of real dollars, there’s also been a dearth of fresh tethers coming in since June. That dearth lasted until October 25 — when a billion tethers were printed and prices suddenly jumped 10%, just in time to liquidate a pile of short-margin traders on FTX.

It is no wonder that

investors are gun-shy:

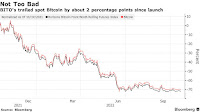

Bitcoin derivatives — assets that derive their value from bitcoin — aren’t doing well either. The ProShares Bitcoin Strategy ETF (BITO) tracks the CME’s bitcoin futures. These are just bets in dollars on the price of bitcoin. Bloomberg Intelligence analyst James Seyffart says: “If you just want exposure to Bitcoin” — i.e., not doing anything so gauche as touching a bitcoin — “BITO is the best option in the ETF landscape, at least in the US.” But in the more than a year that it’s existed, BITO has performed even worse than bitcoin itself. BITO holders have mostly stayed holding, so its holders are just like bitcoin bagholders too. [Bloomberg]

A year ago BITO, an ETF that uses futures contracts to track the BTC "price", launched to much acclaim and $1.1B of investors' actual dollars in two days. Vildana Hajric and Katherine Greifeld's

The Bitcoin Futures ETF at 1: $1.8 Billion Lured, Over Half Lost takes up the story:

But, the ETF wasn’t exactly what die-hard fans had wanted. The fund doesn’t hold Bitcoin directly. Instead, it is based on futures contracts and was filed under mutual fund rules that Securities and Exchange Commission Chairman Gary Gensler had said provided “significant investor protections.”

US regulators have been hesitant to approve a product that tracks the real coin, citing volatility and manipulation, among other things.

|

| Source |

As the graph shows, BITO did an excellent job of tracking BTC. The

result was:

The fund has slumped over 70% since its launch, tracking a crypto collapse that dragged Bitcoin to around $20,000. At a year old, BITO has posted cumulative inflows of more than $1.8 billion, and yet as of Friday had just $619 million left.

“It’s been a bad year -- we’re looking at $1.2 billion burned,” said James Seyffart, a Bloomberg Intelligence analyst. “But if you just want exposure to Bitcoin, BITO is the best option in the ETF landscape, at least in the US.”

This chart shows that, once "number go down" the number of investors who "just want exposure to Bitcoin" is miniscule. The fund is just for devoted HODL-ers.

Ashworth quotes a

Morgan Stanley report:

Almost 1 year into the bitcoin bear market, most who bought bitcoin in 2021 are facing heavy losses and appear to be waiting for any rallies to close their position. A record number of bitcoin units haven’t been used for any transaction in the past 6 months, currently at 78% of total and this number continues to rise (Exhibit 1).

What this means, if we oversimplify a bit, is that those who bought/received bitcoin more than 6 months ago are holding onto their positions, with some likely waiting for a price recovery. For the remaining 22% of bitcoin units held by the shorter term investors who did transact bitcoin in the past 6 months, estimates suggest their average breakeven price is just over $22.3k (+7% from current but was as high as 20% a few days ago, see Exhibit 2)

The more HODL-ing and the less trading, the easier it is for the "leveraged large holders" to pump the "price" to avoid getting liquidated, but not so much that the HODL-ers sell, which is Amy Castor and David Gerard's argument.

It isn't surprising that "more than a quarter of total supply now not having moved on-chain for at least five years", because (a) 5% of the supply has never moved because it is in Nakamoto's wallet, and (b) Chainalysis estimates that about 20% of all Bitcoins have been "lost", or in other words are sitting in wallets whose keys are inaccessible. See The $65B Prize for the implications of this. And yes, the title of that post should now be The $20B Prize.

ReplyDeleteI think another way to see how it's being propped up is to compare the BTC vs USD chart, and BTC vs TETHER chart. USD volumes are tiny whereas Tether volumes are massive and coincide with trying to prop up BTC around 20k.

ReplyDeleteReally appreciate your blog I think it's excellent.

I'm presenting this indicator of the "state of blockchain" without comment. Boris Johnson, former Prime Minister of the United Kingdom, to attend International Symposium on Blockchain Advancements (ISBA) 2022 as Keynote Speaker:

ReplyDelete"Mr Johnson is globally renowned for his passionate leadership on education, technology and infrastructure. His policies are designed to drive investment, creativity and allow innovation to flourish in the UK and around the world."

See also this earlier example of the same indicator, from two weeks before the Terra/Luna crash.

The ex-Prime Minister indicator worked again! Nine days after the Boris Johnson indicator, BTC is below $16K in the wake of CZ's decision to buy, or rather not buy, FTX.

ReplyDeleteThe ex-Prime-Minister sell signal two weeks before the Terra-Luna crash was even better than we knew at the time. This picture shows that it wasn't just Tony Blair and Bill Clinton on stage at CryptoBahamas, it was Sam Bankman-Fried as well!

ReplyDelete54 weeks ago, FTX-backed Solana peaked at $258.78. It is currently at $12.38, down 95.3% in just over a year.

ReplyDeleteMolly White reports on the effects of greater fools not shoowing up in 150 companies seek Binance's bailout for organizations "facing significant, short term, financial difficulties":

ReplyDelete"On November 14, CZ of Binance announced an "industry recovery fund", which he said would devote money to ending "further cascading negative effects of FTX [and] help projects who are otherwise strong, but in a liquidity crisis".

In a blog post outlining the $1 billion initiative, Binance also divulged that "we have already received around 150 applications from companies seeking support under the [Industry Recovery Initiative]"—only a week and a half after it was announced."

From the "well, Duh!" department comes this quote in Emily Nicolle's Bitcoin Lingers Near $28,000; Binance is Hit With Trading Halt:

ReplyDelete"“Crypto markets are at their most volatile when liquidity is low,” said Conor Ryder, research analyst at blockchain data firm Kaiko, in a note Thursday. The market is currently at its lowest level of liquidity in Bitcoin markets in 10 months, Ryder said, following the collapse of several major banking routes into crypto this year."

Crypto markets are easiest to manipulate when liquidity is low. But even pumping BTC 75% up from its $16K low hasn't convinced the suckers to jump in.

Bitcoin Liquidity Is Drying Up as Crypto ‘Tourists’ Recoil From Industry Disorder by Vildana Hajric and Isabelle Lee continues the theme:

ReplyDelete"By just about any measure, Bitcoin liquidity remains low, despite the cryptocurrency’s eye-catching upsurge this year.

Investors have been paying more on trades because of slippage, or the difference between the expected price of a transaction and the price at which it’s fully executed, a sign of worsening liquidity, according to Conor Ryder at Kaiko. The higher the difficulty in trading, the more investors are exposed to potential volatile price swings.

...

Even as a rebound in Bitcoin this year made it the best-performing asset in the first quarter, a widening US regulatory crackdown and the collapse of a few crypto-adjacent banks has tempered some investors’ enthusiasm."